10-20-16 -- James Corbett - Vin Suprynowicz (MP3 & VIDEO LOADED)

Hour 1 - 3

Hour 1 -- James Corbett - (The Corbett Report) World News Update and also the coming economic meltdown with no accountability at the top

Hour 2 -- Vin Suprynowicz (Libertarian Author) on predictions for 2016; Miskatonic Manuscript review

Hour 3 -- Freedom's Phoenix Headline News

CALL IN TO SHOW: 602-264-2800

-30-

January 20th, 2016

Declare Your Independence with Ernest Hancock

on LRN.FM / Monday - Friday

9 a.m. - Noon (EST)

Studio Line: 602-264-2800

Hour 1

2016-01-20 Hour 1 James Corbett from Ernest Hancock on Vimeo.

James Corbett

The Corbett Report

Webpage: CorbettReport.Com

James comes on the show to discuss U.S./World politics/foreign policy, World News Update, and also the coming economic meltdown with no accountability at the top

============================

James's previous interviews on the Declare Your Independence with Ernest Hancock Radio Show:

https://www.freedomsphoenix.com/Guest-Page.htm?No=01092

=============================

TOPICS DISCUSSED...

Government Sachs Gets Golden Wrist Slap For Global Financial Crisis

Corbett • 01/20/2016 •

by James Corbett

by James Corbett

TheInternationalForecaster.com

January 19, 2016

Historians of the future will note Yellen's smiling press conference in December of 2015 to announce the long-awaited rate hike as the beginning of the end for the dead cat bubble of the Global Financial Crisis. In some ways this has been a 20 year long Fed bubble that leads in a straight line from the "irrational exuberance" of the Dot Com bubble to the Dot Com bust and 9/11 to the Greenspan bubble and the subprime housing run-up to the Global Financial Crisis to QE1/2/3 and ZIRP to the rate hike to today. And what do we have today?

The worst start to the year in US equity markets in history.

Downgrades of economic forecasts from every conceivable corner of the financial world.

Probability of US recession (even with the government's cooked books) the highest it's been in 5 years.

The oil slump getting slumpier as Iranian oil comes online.

Driver of world economic growth China hitting its weakest growth pace in 25 years.

The Royal Bank of Scotland warning of "cataclysm" this year and advising investors to "sell everything."

And on and on. You get the picture. But I bet you wish you didn't.

Ironic, then, that in the midst of this beginning-of-the-end of the 8 year long QE re-leveraging heroin binge we have news that seems to put a bow on the 2008 crisis: Goldman Sachs hasannounced that it has reached a $5.1 billion settlement as its wrist slap for participating in the wholesale swindle that was the subprime mortgage meltdown. The settlement breaks down into $2.385 billion in civil monetary penalties, $875 million in cash payments and $1.8 billion in consumer relief.

Here's the kicker: the settlement is the largest in the bank's history, but still small potatoes compared to some of its cohorts in crime who have already reached their settlements, such as Bank of America ($16.6 billion) and JPMorgan Chase ($13 billion).

Here's the kicker: the settlement is the largest in the bank's history, but still small potatoes compared to some of its cohorts in crime who have already reached their settlements, such as Bank of America ($16.6 billion) and JPMorgan Chase ($13 billion).

For those who don't remember the subprime mortgage meltdown and Goldman's role in it (along with the other big banks), they intentionally blew up the housing bubble by creating Structured Investment Vehicles to keep mortgage backed securities and other risky investments off their main books. This allowed them to raise money on the commercial paper market at low interest rates and earn high interest rates by buying toxic subprime mortgage securities. Then they paid off the ratings agencies to AAA certify their toxic mortgage CDO garbage.

Then (and here's the psychopathic genius of it) knowing that it was all going to melt down sooner or later, they pawned the subprime-backed derivative garbage on their customers at the same time as they secretly bet against it. Internal emails released in subsequent investigationsshow they referred to their own CDOs as "sh***y deals" and called their customers "muppets" for buying them.

The end result? Goldman had its most profitable year to date in 2007 as the market started to turn with a staggering $17.6 billion profit. By 2009, in the depths of the crisis that they helped bring about and as the rest of the world faced total financial armageddon, they did even better, netting just shy of $20 billion profit.

So, just to recap: Goldman makes tens of billions by selling the very toxic assets they were secretly betting against and in the end they pay a $5 billion penalty.

So, just to recap: Goldman makes tens of billions by selling the very toxic assets they were secretly betting against and in the end they pay a $5 billion penalty.

…Oh, and (needless to say) the Injustice Department practically fell over themselves to announce at the earliest possible opportunity that no one would even be prosecuted for this fraud (let alone go to jail).

…Oh, and poor Goldman will make a slightly smaller profit this year as a result of this golden wrist slap, equivalent to one measly fiscal quarter of profit for the banking behemoth.

All hail Government Sachs, surely a Vampire Squid if ever there was one. And now that their last engineered crisis has been finally covered up for good, it's time to live through the next one. Happy 2016!

=============================

Other pertinent topics...

By Mike Hearn Jan 1418 min read

https://medium.com/@octskyward/the-resolution-of-the-bitcoin-experiment-dabb30201f7#.jpbegicx9

The resolution of the Bitcoin experiment

I've spent more than 5 years being a Bitcoin developer. The software I've written has been used by millions of users, hundreds of developers, and the talks I've given have led directly to the creation of several startups. I've talked about Bitcoin on Sky TV and BBC News. I have been repeatedly cited by the Economist as a Bitcoin expert and prominent developer. I have explained Bitcoin to the SEC, to bankers and to ordinary people I met at cafes.

From the start, I've always said the same thing: Bitcoin is an experiment and like all experiments, it can fail. So don't invest what you can't afford to lose. I've said this in interviews, on stage at conferences, and over email. So have other well known developers like Gavin Andresen and Jeff Garzik.

But despite knowing that Bitcoin could fail all along, the now inescapable conclusion that it has failed still saddens me greatly. The fundamentals are broken and whatever happens to the price in the short term, the long term trend should probably be downwards. I will no longer be taking part in Bitcoin development and have sold all my coins.

Why has Bitcoin failed? It has failed because the community has failed. What was meant to be a new, decentralised form of money that lacked "systemically important institutions" and "too big to fail" has become something even worse: a system completely controlled by just a handful of people. Worse still, the network is on the brink of technical collapse. The mechanisms that should have prevented this outcome have broken down, and as a result there's no longer much reason to think Bitcoin can actually be better than the existing financial system.

Think about it. If you had never heard about Bitcoin before, would you care about a payments network that:

Couldn't move your existing money

Had wildly unpredictable fees that were high and rising fast

Allowed buyers to take back payments they'd made after walking out of shops, by simply pressing a button (if you aren't aware of this "feature" that's because Bitcoin was only just changed to allow it)

Is suffering large backlogs and flaky payments

… which is controlled by China

… and in which the companies and people building it were in open civil war?

I'm going to hazard a guess that the answer is no.

. . .

Deadlock on the blocks

In case you haven't been keeping up with Bitcoin, here is how the network looks as of January 2016.

The block chain is full. You may wonder how it is possible for what is essentially a series of files to be "full". The answer is that an entirely artificial capacity cap of one megabyte per block, put in place as a temporary kludge a long time ago, has not been removed and as a result the network's capacity is now almost completely exhausted.

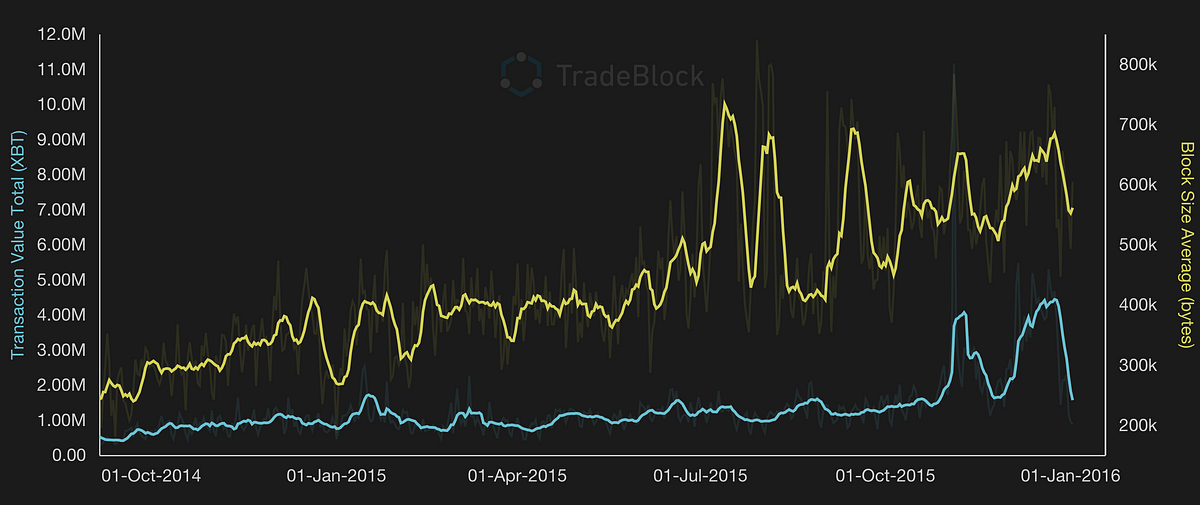

Here's a graph of block sizes.

The peak level in July was reached during a denial-of-service attack in which someone flooded the network with transactions in an attempt to break things, calling it a "stress test". So that level, about 700 kilobytes of transactions (or less than 3 payments per second), is probably about the limit of what Bitcoin can actually achieve in practice

NB: You may have read that the limit is 7 payments per second. That's an old figure from 2011 and Bitcoin transactions got a lot more complex since then, so the true figure is a lot lower.

The reason the true limit seems to be 700 kilobytes instead of the theoretical 1000 is that sometimes miners produce blocks smaller than allowed and even empty blocks, despite that there are lots of transactions waiting to confirm?—?this seems to be most frequently caused by interference from the Chinese "Great Firewall" censorship system. More on that in a second.

If you look closely, you can see that traffic has been growing since the end of the 2015 summer months. This is expected. I wrote about Bitcoin's seasonal growth patterns back in March.

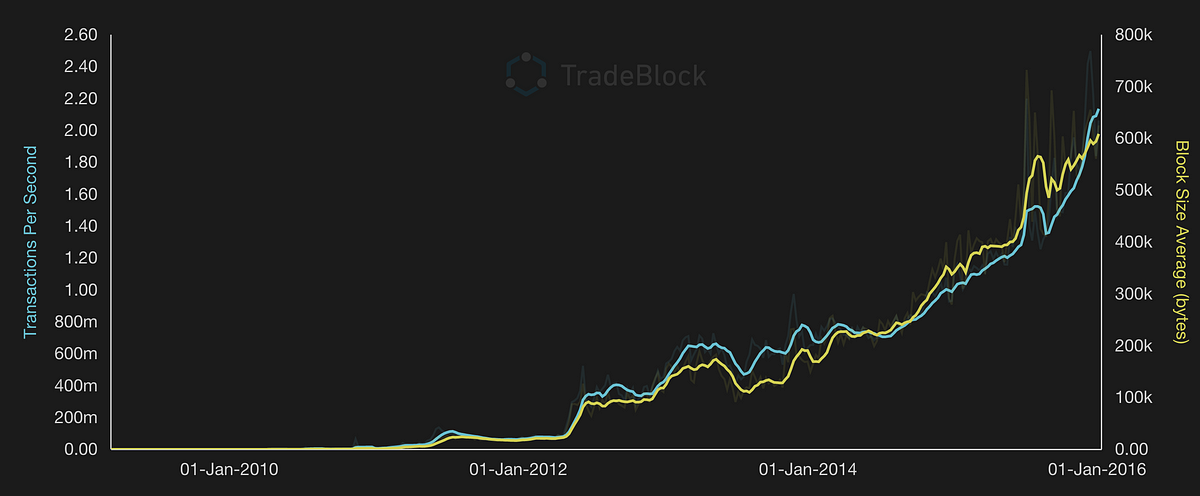

Here's weekly average block sizes:

So the average is nearly at the peak of what can be done. Not surprisingly then, there are frequent periods in which Bitcoin can't keep up with the transaction load being placed upon it and almost all blocks are the maximum size, even when there is a long queue of transactions waiting. You can see this in the size column (the 750kb blocks come from miners that haven't properly adjusted their software):

When networks run out of capacity, they get really unreliable. That's why so many online attacks are based around simply flooding a target computer with traffic. Sure enough, just before Christmas payments started to become unreliable and at peak times backlogs are now becoming common.

Quoting a news post by ProHashing, a Bitcoin-using business:

Some customers contacted Chris earlier today asking why our bitcoin payouts didn't execute …

The issue is that it's now officially impossible to depend upon the bitcoin network anymore to know when or if your payment will be transacted, because the congestion is so bad that even minor spikes in volume create dramatic changes in network conditions. To whom is it acceptable that one could wait either 60 minutes or 14 hours, chosen at random?

It's ludicrous that people are actually writing posts on reddit claiming that there is no crisis. People were criticizing my post yesterday on the grounds that I somehow overstated the seriousness of the situation. Do these people actually use the bitcoin network to send money everyday?

ProHashing encountered another near-miss between Christmas and New Year, this time because a payment from an exchange to their wallet was delayed.

Bitcoin is supposed to respond to this situation with automatic fee rises to try and get rid of some users, and although the mechanisms behind it are barely functional that's still sort of happening: it is rapidly becoming more and more expensive to use the Bitcoin network. Once upon a time, Bitcoin had the killer advantage of low and even zero fees, but it's now common to be asked to pay more to miners than a credit card would charge.

Why has the capacity limit not been raised? Because the block chain is controlled by Chinese miners, just two of whom control more than 50% of the hash power. At a recent conference over 95% of hashing power was controlled by a handful of guys sitting on a single stage. The miners are not allowing the block chain to grow.

Why are they not allowing it to grow? Several reasons. One is that the developers of the "Bitcoin Core" software that they run have refused to implement the necessary changes. Another is that the miners refuse to switch to any competing product, as they perceive doing so as "disloyalty" —and they're terrified of doing anything that might make the news as a "split" and cause investor panic. They have chosen instead to ignore the problem and hope it goes away.

And the final reason is that the Chinese internet is so broken by their government's firewall that moving data across the border barely works at all, with speeds routinely worse than what mobile phones provide. Imagine an entire country connected to the rest of the world by cheap hotel wifi, and you've got the picture. Right now, the Chinese miners are able to?—?just about?—?maintain their connection to the global internet and claim the 25 BTC reward ($11,000) that each block they create gives them. But if the Bitcoin network got more popular, they fear taking part would get too difficult and they'd lose their income stream. This gives them a perverse financial incentive to actually try and stop Bitcoin becoming popular.

Many Bitcoin users and observers have been assuming up until very recently that somehow these problems would all sort themselves out, and of course the block chain size limit would be raised. After all, why would the Bitcoin community … the community that has championed the block chain as the future of finance … deliberately kill itself by strangling the chain in its crib? But that's exactly what is happening.

The resulting civil war has seen Coinbase?—?the largest and best known Bitcoin startup in the USA?—?be erased from the official Bitcoin website for picking the "wrong" side and banned from the community forums. When parts of the community are viciously turning on the people that have introduced millions of users to the currency, you know things have got really crazy.

Nobody knows what's going on

If you haven't heard much about this, you aren't alone. One of the most disturbing things that took place over the course of 2015 is that the flow of information to investors and users has dried up.

In the span of only about eight months, Bitcoin has gone from being a transparent and open community to one that is dominated by rampant censorship and attacks on bitcoiners by other bitcoiners. This transformation is by far the most appalling thing I have ever seen, and the result is that I no longer feel comfortable being associated with the Bitcoin community.

Bitcoin is not intended to be an investment and has always been advertised pretty accurately: as an experimental currency which you shouldn't buy more of than you can afford to lose. It is complex, but that never worried me because all the information an investor might want was out there, and there's an entire cottage industry of books, conferences, videos and websites to help people make sense of it all.

That has now changed.

Most people who own Bitcoin learn about it through the mainstream media. Whenever a story goes mainstream the Bitcoin price goes crazy, then the media report on the price rises and a bubble happens.

Stories about Bitcoin reach newspapers and magazines through a simple process: the news starts in a community forum, then it's picked up by a more specialised community/tech news website, then journalists at general media outlets see the story on those sites and write their own versions. I've seen this happen over and over again, and frequently taken part in it by discussing stories with journalists.

In August 2015 it became clear that due to severe mismanagement, the "Bitcoin Core" project that maintains the program that runs the peer-to-peer network wasn't going to release a version that raised the block size limit. The reasons for this are complicated and discussed below. But obviously, the community needed the ability to keep adding new users. So some long-term developers (including me) got together and developed the necessary code to raise the limit. That code was called BIP 101 and we released it in a modified version of the software that we branded Bitcoin XT. By running XT, miners could cast a vote for changing the limit. Once 75% of blocks were voting for the change the rules would be adjusted and bigger blocks would be allowed.

The release of Bitcoin XT somehow pushed powerful emotional buttons in a small number of people. One of them was a guy who is the admin of the bitcoin.org website and top discussion forums. He had frequently allowed discussion of outright criminal activity on the forums he controlled, on the grounds of freedom of speech. But when XT launched, he made a surprising decision. XT, he claimed, did not represent the "developer consensus" and was therefore not really Bitcoin. Voting was an abomination, he said, because:

"One of the great things about Bitcoin is its lack of democracy"

So he decided to do whatever it took to kill XT completely, starting with censorship of Bitcoin's primary communication channels: any post that mentioned the words "Bitcoin XT" was erased from the discussion forums he controlled, XT could not be mentioned or linked to from anywhere on the official bitcoin.org website and, of course, anyone attempting to point users to other uncensored forums was also banned. Massive numbers of users were expelled from the forums and prevented from expressing their views.

As you can imagine, this enraged people. Read the comments on the announcement to get a feel for it.

Eventually, some users found their way to a new uncensored forum. Reading it is a sad thing. Every day for months I have seen raging, angry posts railing against the censors, vowing that they will be defeated.

But the inability to get news about XT or the censorship itself through to users has some problematic effects.

For the first time, investors have no obvious way to get a clear picture of what's going on. Dissenting views are being systematically suppressed. Technical criticisms of what Bitcoin Core is doing are being banned, with misleading nonsense being peddled in its place. And it's clear that many people who casually bought into Bitcoin during one of its hype cycles have no idea that the system is about to hit an artificial limit.

This worries me a great deal. Over the years governments have passed a large number of laws around securities and investments. Bitcoin is not a security and I do not believe it falls under those laws, but their spirit is simple enough: make sure investors are informed. When misinformed investors lose money, government attention frequently follows.

. . .

Why is Bitcoin Core keeping the limit?

People problems.

When Satoshi left, he handed over the reins of the program we now call Bitcoin Core to Gavin Andresen, an early contributor. Gavin is a solid and experienced leader who can see the big picture. His reliable technical judgement is one of the reasons I had the confidence to quit Google (where I had spent nearly 8 years) and work on Bitcoin full time. Only one tiny problem: Satoshi never actually asked Gavin if he wanted the job, and in fact he didn't. So the first thing Gavin did was grant four other developers access to the code as well. These developers were chosen quickly in order to ensure the project could easily continue if anything happened to him. They were, essentially, whoever was around and making themselves useful at the time.

One of them, Gregory Maxwell, had an unusual set of views: he once claimed he had mathematically proven Bitcoin to be impossible. More problematically, he did not believe in Satoshi's original vision.

When the project was first announced, Satoshi was asked how a block chain could scale to a large number of payments. Surely the amount of data to download would become overwhelming if the idea took off? This was a popular criticism of Bitcoin in the early days and Satoshi fully expected to be asked about it. He said:

The bandwidth might not be as prohibitive as you think … if the network were to get [as big as VISA], it would take several years, and by then, sending [the equivalent of] 2 HD movies over the Internet would probably not seem like a big deal.

It's a simple argument: look at what existing payment networks handle, look at what it'd take for Bitcoin to do the same, and then point out that growth doesn't happen overnight. The networks and computers of the future will be better than today. And indeed back-of-the-envelope calculations suggested that, as he said to me, "it never really hits a scale ceiling" even when looking at more factors than just bandwidth.

Maxwell did not agree with this line of thinking. From an interview in December 2014:

Problems with decentralization as bitcoin grows are not going to diminish either, according to Maxwell: "There's an inherent tradeoff between scale and decentralization when you talk about transactions on the network."

The problem, he said, is that as bitcoin transaction volume increases, larger companies will likely be the only ones running bitcoin nodes because of the inherent cost.

The idea that Bitcoin is inherently doomed because more users means less decentralisation is a pernicious one. It ignores the fact that despite all the hype, real usage is low, growing slowly and technology gets better over time. It is a belief Gavin and I have spent much time debunking. And it leads to an obvious but crazy conclusion: if decentralisation is what makes Bitcoin good, and growth threatens decentralisation, then Bitcoin should not be allowed to grow.

Instead, Maxwell concluded, Bitcoin should become a sort of settlement layer for some vaguely defined, as yet un-created non-blockchain based system.

The death spiral begins

In a company, someone who did not share the goals of the organisation would be dealt with in a simple way: by firing him.

But Bitcoin Core is an open source project, not a company. Once the 5 developers with commit access to the code had been chosen and Gavin had decided he did not want to be the leader, there was no procedure in place to ever remove one. And there was no interview or screening process to ensure they actually agreed with the project's goals.

As Bitcoin became more popular and traffic started approaching the 1mb limit, the topic of raising the block size limit was occasionally brought up between the developers. But it quickly became an emotionally charged subject. Accusations were thrown around that raising the limit was too risky, that it was against decentralisation, and so on. Like many small groups, people prefer to avoid conflict. The can was kicked down the road.

Complicating things further, Maxwell founded a company that then hired several other developers. Not surprisingly, their views then started to change to align with that of their new boss.

Co-ordinating software upgrades takes time, and so in May 2015 Gavin decided the subject must be tackled once and for all, whilst there was still about 8 months remaining. He began writing articles that worked through the arguments against raising the limit, one at a time.

But it quickly became apparent that the Bitcoin Core developers were hopelessly at loggerheads. Maxwell and the developers he had hired refused to contemplate any increase in the limit whatsoever. They were barely even willing to talk about the issue. They insisted that nothing be done without "consensus". And the developer who was responsible for making the releases was so afraid of conflict that he decided any controversial topic in which one side might "win" simply could not be touched at all, and refused to get involved.

Thus despite the fact that exchanges, users, wallet developers, and miners were all expecting a rise, and indeed, had been building entire businesses around the assumption that it would happen, 3 of the 5 developers refused to touch the limit.

Deadlock.

Meanwhile, the clock was ticking.

Massive DDoS attacks on XT users

Despite the news blockade, within a few days of launching Bitcoin XT around 15% of all network nodes were running it, and at least one mining pool had started offering BIP101 voting to miners.

That's when the denial of service attacks started. The attacks were so large that they disconnected entire regions from the internet:

"I was DDos'd. It was a massive DDoS that took down my entire (rural) ISP. Everyone in five towns lost their internet service for several hours last summer because of these criminals. It definitely discouraged me from hosting nodes."

In other cases, entire datacenters were disconnected from the internet until the single XT node inside them was stopped. About a third of the nodes were attacked and removed from the internet in this way.

Worse, the mining pool that had been offering BIP101 was also attacked and forced to stop. The message was clear: anyone who supported bigger blocks, or even allowed other people to vote for them, would be assaulted.

The attackers are still out there. When Coinbase, months after the launch, announced they had finally lost patience with Core and would run XT, they too were forced offline for a while.

Bogus conferences

Despite the DoS attacks and censorship, XT was gaining momentum. That posed a threat to Core, so a few of its developers decided to organise a series of conferences named "Scaling Bitcoin": one in August and one in December. The goal, it was claimed, was to reach "consensus" on what should be done. Everyone likes a consensus of experts, don't they?

It was immediately clear to me that people who refused to even talk about raising the limit would not have a change of heart because they attended a conference, and moreover, with the start of the winter growth season there remained only a few months to get the network upgraded. Wasting those precious months waiting for conferences would put the stability of the entire network at risk. The fact that the first conference actually banned discussion of concrete proposals didn't help.

So I didn't go.

Unfortunately, this tactic was devastatingly effective. The community fell for it completely. When talking to miners and startups, "we are waiting for Core to raise the limit in December" was one of the most commonly cited reasons for refusing to run XT. They were terrified of any media stories about a community split that might hurt the Bitcoin price and thus, their earnings.

Now the last conference has come and gone with no plan to raise the limit, some companies (like Coinbase and BTCC) have woken up to the fact that they got played. But too late. Whilst the community was waiting, organic growth added another 250,000 transactions per day.

A non-roadmap

Jeff Garzik and Gavin Andresen, the two of five Bitcoin Core committers who support a block size increase (and the two who have been around the longest), both have a stellar reputation within the community. They recently wrote a joint article titled "Bitcoin is Being Hot-Wired for Settlement".

Jeff and Gavin are generally softer in their approach than I am. I'm more of a tell-it-like-I-see-it kinda guy, or as Gavin has delicately put it, "honest to a fault". So the strong language in their joint letter is unusual. They don't pull any punches:

The proposed roadmap currently being discussed in the bitcoin community has some good points in that it does have a plan to accommodate more transactions, but it fails to speak plainly to bitcoin users and acknowledge key downsides.

Core block size does not change; there has been zero compromise on that issue.

In an optimal, transparent, open source environment, a BIP would be produced … this has not happened

One of the explicit goals of the Scaling Bitcoin workshops was to funnel the chaotic core block size debate into an orderly decision making process. That did not occur. In hindsight, Scaling Bitcoin stalled a block size decision while transaction fee price and block space pressure continue to increase.

Failing to speak plainly, as they put it, has become more and more common. As an example, the plan Gavin and Jeff refer to was announced at the "Scaling Bitcoin" conferences but doesn't involve making anything more efficient, and manages an anemic 60% capacity increase only through an accounting trick (not counting some of the bytes in each transaction). It requires making huge changes to nearly every piece of Bitcoin-related software. Instead of doing a simple thing and raising the limit, it chooses to do an incredibly complicated thing that might buy months at most, assuming a huge coordinated effort.

Replace by fee

One problem with using fees to control congestion is that the fee to get to the front of the queue might change after you made a payment. Bitcoin Core has a brilliant solution to this problem?—?allow people to mark their payments as changeable after they've been sent, up until they appear in the block chain. The stated intention is to let people adjust the fee paid, but in fact their change also allows people to change the payment to point back to themselves, thus reversing it.

At a stroke, this makes using Bitcoin useless for actually buying things, as you'd have to wait for a buyer's transaction to appear in the block chain … which from now on can take hours rather than minutes, due to the congestion.

Core's reasoning for why this is OK goes like this: it's no big loss because if you hadn't been waiting for a block before, there was a theoretical risk of payment fraud, which means you weren't using Bitcoin properly. Thus, making that risk a 100% certainty doesn't really change anything.

In other words, they don't recognise that risk management exists and so perceive this change as zero cost.

This protocol change will be released with the next version of Core (0.12), so will activate when the miners upgrade. It was massively condemned by the entire Bitcoin community but the remaining Bitcoin Core developers don't care what other people think, so the change will happen.

If that didn't convince you Bitcoin has serious problems, nothing will. How many people would think bitcoins are worth hundreds of dollars each when you soon won't be able to use them in actual shops?

Conclusions

Bitcoin has entered exceptionally dangerous waters. Previous crises, like the bankruptcy of Mt Gox, were all to do with the services and companies that sprung up around the ecosystem. But this one is different: it is a crisis of the core system, the block chain itself.

More fundamentally, it is a crisis that reflects deep philosophical differences in how people view the world: either as one that should be ruled by a "consensus of experts", or through ordinary people picking whatever policies make sense to them.

Even if a new team was built to replace Bitcoin Core, the problem of mining power being concentrated behind the Great Firewall would remain. Bitcoin has no future whilst it's controlled by fewer than 10 people. And there's no solution in sight for this problem: nobody even has any suggestions. For a community that has always worried about the block chain being taken over by an oppressive government, it is a rich irony.

Still, all is not yet lost. Despite everything that has happened, in the past few weeks more members of the community have started picking things up from where I am putting them down. Where making an alternative to Core was once seen as renegade, there are now two more forks vying for attention (Bitcoin Classic and Bitcoin Unlimited). So far they've hit the same problems as XT but it's possible a fresh set of faces could find a way to make progress.

There are many talented and energetic people working in the Bitcoin space, and in the past five years I've had the pleasure of getting to know many of them. Their entrepreneurial spirit and alternative perspectives on money, economics and politics were fascinating to experience, and despite how it's all gone down I don't regret my time with the project. I woke up this morning to find people wishing me well in the uncensored forum and asking me to stay, but I'm afraid I've moved on to other things. To those people I say: good luck, stay strong, and I wish you the best.

==============================

And...

Black vs White Bitcoins... (UPDATE Sat. July 26th 2014)

Written by Ernest Hancock

Website: www.ernesthancock.com

Date: 07-23-2014

Subject: Bitcoin

(Saturday July 26th 2014 - I took some time to see what was behind the inclusion of cryto-currencies into world banking... interesting things have been happening over the last year and then in recent days and even hours.

"It won't happen all at once, but it will happen overnight"... and Monday is just a couple of days away. Peace, Ernie)

The original posting of my concerns are immediately below... the update has been added after.

-----------------

Thursday July 24th 2014:

I'm getting nervous for these guys.

Cody Wilson and Amir Taaki are definitely the guys to talk to about Dark Wallet/Black "unapproved" Bitcoin use etc. but I'm taking the position that if you have to defend against state actions and decrees then you are in the wrong place doing the wrong thing.

Cody may be the PR contact and a great spokesperson for the Dark Wallet effort and its supporting philosophy but I'm getting the impression that Amir and others are the muscle behind the effort... and I'm certain there is a long line of other talented individuals ready to free the planet as well.

Government's laws are one thing and international banking regulations are another (lots of overlap), but I'm getting the impression that Banking trumps government, or at least there isn't a lot of lag time between desires of 'The Banks' and law/policy via whatever government is involved. Even small 'independent nations' are not as autonomous as is hoped.

So I need help understanding something that may be simple for some.

What is the area of international banking law to examine and the terminology used to discover the exposure that the advocates for a 'Dark Wallet' might be targeted with?

A Digital Hong Kong/Singapore/Panama/Dubai has the potential to rise from the ashes of abandoned Fiat Currencies... and this is a very large threat to the status quo.

Some of the most talented and useful individuals in cryptography (planet freeing stuff) are teeing themselves up for a driver to the head… IMO.

I can feel the IMF and World Bank and BIS and BRICS efforts et alia, moving chess pieces all over the world in response to cryptocurrencies and 'They/Them/Those' (that just won't leave us alone) have already made sure that they have a list of incarcerated individuals to use as helpful propaganda in their fear campaign to squash innovation.

The next highly publicized "rendition" will be surrounded around the issue of 'secret' accounts 'laundered' through Banks/Businesses/Casinos on small Caribbean/Indonesian/South Pacific island nations of _Fill in the Blank_.

Warning these young guys about these dangers has limited effect since these are the battles they intended to engage in.

I interviewed Jeffery Tucker and Paul Snow today and the Bitcoin Community is definitely splitting on the continued promotion of Bitcoin. Regulations requiring 'Compliance Officers' are supported by the Bitcoin start ups that have compliance officers (shocking) and this revolutionary tech will easily turn into the Cashless Society (please do your own search) we've been threatened with for so long. And the younger idealistic activist and advocates in the Liberty Movement don't even know what we are concerned about.

Some states, like Texas, will put up a token resistance for a limited time but we know where this ends,… and any country's (or US State's) resistance to getting in line with the Global Regulators will be short lived. I do understand that the technology itself is the threat, and so do governments/banks. This is why I'm reminded of all the rhetoric around the initial release of PGP in the early 90's. Crypto-Tech may even be determined to be illegal by Executive We Rule You Decree via the crown of the international consortium of 'We Can'. In fact, this was the position taken by the USG regarding PGP. As early as 1987 we understood what was really the issue...

From Crossbows To Cryptography

Many of our activist friends are already planning a very public exit from Bitcoin promotions (Maidsafe Safecoins just became a lot more valuable… we'll see if that tech is allowed… coming soon).

Precious Metal dealers are already creating new campaigns that promote Silver as the Real Bitcoin Cold Storage etc. and many others will follow (the Silver Calculator Appjust got more valuable too).

When Gerald Celente got nailed by MF Global I asked for some help understanding what happened and Charles Goyette provided me a single word that he said would provide me all of the understanding I needed… "rehypothecation". From that single word I was able to quickly understand what happened and warn others not to put themselves into a situation that Gerald 'Totally Agreed' to.

NYDFS released its CryptoCurrency Regulation Press Release (on Reddit ???) and theprice of Bitcoin didn't move, Dell Computer announces it's starting to take Bitcoin… nothing. "Stability" of Bitcoin had been an important issue in the minds of those hoping to regulate it and it seems that a steady price is what we're getting.... makes you go Hummmmm.

Soooo, I am willing to speculate a bit more. Not only will governments wrap their arms and legs around a regulated Bitcoin/CryptoCurrency, they will make alternatives illegal. Legal Tender Laws just went digital. And your Local Bitcoin exchange at the local diner just got riskier.

A BitLicense will soon be followed by, or morphed into, an Internet License. Heck, try to get an email now anonymously. And if you are successful getting an anonymous email account, don't be fooled into thinking that you can keep it secret.

So I'm asking for a little help...

I am of the opinion that competing central banks around the world have a common enemy... it's us. Individuals seeking the ability to trade and communicate with each other regardless of geography are the threat. Fear and intimidation are the mind killers and we are in for a mind killing spree that will Not go unnoticed.

I'm of the opinion that "End the Fed" style efforts are a waste of time and all I want to do is 'Ignore the Fed & Friends'.

But all my experiences have set off my 'Spidey Senses' and I feel the need to warn those advocating for a direct head to head battle with the Central Banks of the likelihood that this is the battle they desire.

If anyone can point me to International Banking agreements that require all 'member' banks/countries to adopt regulations regarding new currencies, that would be a great help. Even the terminology used to search for such things would be a help.

In the meantime I advocate for not engaging with The State if at all possible. And with Crypto... it's possible.

Peace,

Ernie

==============================================

Friday July 25th 2014:

07-25-14-- Daniel Larimer, BitShares - Cody Wilson, Dark Wallet Bitcoin (MP3 & VIDEO+BONUS LOADED)

==============================================

Saturday July 26th 2014 UPDATE...

Cui bono ("with benefit to whom?") Wikipedia

"It is a Latin adage that is used either to suggest a hidden motive or to indicate that the party responsible for something may not be who it appears at first to be."

I suspect that you want names and entities and addresses etc. But then what? The problem is us. We are soooo dependent on systems and variations of systems that we have forgotten how to trade and barter with one another to the point that we can't even feed ourselves. We are seen as livestock on a planetary feed lot and there is little need, and absolutely No desire, to include us in the negotiations for our slaughter... FYI

News Link • News Link •  Economy - Economics USA Prepare for This Seismic Currency Shift (and Profit) 07-26-2014 • http://moneymorning.com Major new laws like FATCA (Foreign Account Tax Compliance Act) and a growing acceptance by major governments of a digital currency, like Bitcoin, are simply setting the stage.(Stage setting for...)... |

"You never let a serious crisis go to waste. And what I mean by that it's an opportunity to do things you think you could not do before." -Rahm Emanuel

That, I'm afraid, is exactly what will happen when (not if) the next major economic crisis hits. I'd even venture to guess it's Rule No. 1 in the "central planners" rulebook.

Major new laws like FATCA (Foreign Account Tax Compliance Act) and a growing acceptance by major governments of a digital currency, like Bitcoin, are simply setting the stage. (check out the Bitcoin hyperlink for some additional perspective)

The ultimate goal is to establish and roll out a single, planetary currency regime. There will, quite simply, be no alternative available.

It's all about control.

---------------------

What represents the Hub of global finance?

Where is it that ALL major banking interests go for permission/absolution?

http://mises.org/books/Rothbard_What_Has_Government_Done.pdf

What Has Government Done to Our Money - Murray Rothbard

6. Phase VI:

The Unraveling of Bretton Woods,

1968 ??"1971

Along with this, the United States pushed hard

for the new launching of a new kind of world paper

reserve, Special Drawing Rights (SDRs), which it was

hoped would eventually replace gold altogether and<

Hour 2

Hour 2 -- Vin Suprynowicz (Libertarian Author) on his new book, Miskatonic Mansucript

-30-

Hour 2

2016-01-20 Hour 2 Vin Suprynowicz from Ernest Hancock on Vimeo.

Vin Suprynowicz

Libertarian Author comes on the show to discuss his new book, Miskatonic Mansucript

Also, predictions for 2016...

Webpage: VinSuprynowicz.Com

The Miskatonic Manuscript / from the Case Files of Matthew Hunter and Chantal Stevens

Available on Amazon (Kindle) Now:

And Also Available on AbeBooks NOW!

http://www.vinsuprynowicz.com/?p=2514

What if Rhode Island horror writer H.P. Lovecraft didn't just imagine the "resonator" in his 1920 short story "From Beyond"? What if Henry Annesley actually built the machine that allowed him to see into the Sixth Dimension -– and allowed creatures from The Other Side to invade us here?

Facing Draconian prison sentences, their Cthulhian Church banned by the federal drug warriors for employing holy sacraments that actually work, Windsor and Worthington Annesley turn to a desperate search for their great-uncle's resonator, hoping it may be the game-changer they need.

Does the secret lie in a lost Lovecraft notebook? Can rare book dealers Matthew Hunter and Chantal Stevens find it in time? If they do, the Annesley Brothers vow to finally ask the question that victims of the Drug War have been waiting a hundred years to hear:

"What if they fought a War on Drugs . . . and someone fought back?"

From the author of "The Testament of James" comes another adventure from the case files of Matthew Hunter and Chantal Stevens, complete with rampaging tyrannosaurs, naked jungle girls, man-eating spiders, and some seriously heavy drugs . . . "The Miskatonic Manuscript."

It ain't your grandpa's used book store.

# # #

Our cover illustration, "Bidge turns to give the alarm," is copyright (c) Boris Vallejo.

ABOUT THE AUTHOR

Deep in the Nevada desert, in a hidden mansion full of old books and vintage clothes, guarded by four-and-a-half anthropomorphic cats and a family of Attack Roadrunners, Vin Suprynowicz went cold turkey from a 40-year newspaper career. They said he'd never write anything over a thousand words, again. But with the help and encouragement of the Brunette and a few close friends, he came back. With "The Testament of James," he proved them wrong. Now comes the second drug-enhanced adventure of Matthew Hunter and Chantal Stevens, "The Miskatonic Manuscript." In an earlier life, Vin wrote "Send in the Waco Killers," "The Ballad of Carl Drega," and the freedom novel "The Black Arrow."

PRAISE FOR THE FIRST ENTRY IN THE SERIES,

'THE TESTAMENT OF JAMES'

"The characters who populate the book are quirky, literate, cunning and engage in snappy, irreverent and amusing dialogue — from book dealer Matthew, who must keep patiently explaining why certain books cost more than they did when new, to pink pistol packing Chantal. . . . Even the cats have personalities."

-– Thomas Mitchell, formerly The Editor, Las Vegas Review-Journal

"Testament's pace is anything but slow, proceeding like clever dinner conversation amongst your brightest friends. . . . Matthew Hunter has a love interest and partner in Chantal Stevens, characters who will continue their book sleuthing heroics in future installments. There's psilocybin use and cats with names like Mr. Cuddles and Tabbyhunter providing clues to impending danger. . . . The Testament of James is a quick, entertaining read to either remind you you're not crazy, or start you on a journey to truth and enlightenment."

-– Doug French, banker, economist, student of Murray Rothbard

"Now and then I see reviewers refer to a novel as a 'romp.' I don't know that I've ever done so before, but I'll do so now. . . . The pacing is perfect and the reader (this reader, anyway) is left both satisfied with the story and wanting more of the characters and of the world it happens in."

– Thomas Knapp

"As a mystery, this book works superbly. Its view of 'bookmen' (hunters, sellers, and collectors) is a delight."

– John Walker, programming entrepreneur, co-founder of Autodesk

"Entertaining, funny, and thought-provoking."

-– A.D. Hopkins, member, Nevada Newspaper Hall of Fame

==========================================================

TOPICS DISCUSSED...

Vin's 2nd Amendment Articles

http://www.vinsuprynowicz.com/?cat=8

What is a 'gun found at crime scene'?

Tuesday, December 1st, 2015

(A version of this column appears in the Dec. 10 edition of "Shotgun News.") In October, jurors ordered a Wisconsin gun store to pay nearly $6 million in damages in a lawsuit filed by two Milwaukee police officers who were shot and seriously wounded by a gun purchased at the store, The Associated Press reports.

OK, let's talk about the 'staggering human toll'

Tuesday, November 3rd, 2015

Columnist Scott Lemieux, who teaches political science at the College of St. Rose in Albany, wrote on Aug. 26 for the left-leaning, British-based newspaper "The Guardian": "After the 24-year-old television reporter Alison Parker and her 27-year-old cameraman Adam Ward were killed while on camera from a lake outside of Roanoke, Virginia . . . the […]

Wednesday, September 30th, 2015

As expected, three gun-rights groups — the National Rifle Association, the National Shooting Sports Foundation, and the Second Amendment Foundation — have sued the city of Seattle over the City Council's unanimous August adoption of a so-called "gun violence tax." The lawsuit accuses the city of violating Washington state law, which prohibits local governments from […]

Dems can't help themselves . . . it's guns once again

Friday, September 4th, 2015

What's that? The next presidential election is still 14 months away? Sorry, but Americans are sports fans, and they've expressed a growing preference for the multi-level "playoff." Not enough anymore for a team to be quietly awarded a trophy or "pennant" for simply winning the most games over the course of a long season. No. […]

If we don't have 'common-sense gun control' now, time to start over

Wednesday, August 5th, 2015

"There is no greater coward than a criminal who enters a house of God and slaughters innocent people engaged in the study of scripture," said Cornell William Brooks, president of the National Association for the Advancement of Colored People, after a visitor to a Bible study group at the historic Emanuel African Methodist Episcopal Church […]

Gun control, which never worked, loses more ground

Friday, July 3rd, 2015

As of July 1, Kansas residents are again be able to lawfully carry concealed handguns without a permit. Introduced in the state Senate in January with an impressive 26 co-sponsors, the Sunflower State's new "Constitutional carry" bill swept the senate 31-7 and cleared the house in March by a bipartisan 85-39 margin, reports Chris Eger, […]

'Background checks': Trojan Horse for registration

Sunday, June 7th, 2015

What's the big deal about requiring background checks for private firearm sales? If you want to sell your gun to your neighbor, you just telephone the National Instant Check hotline and ask to have your potential buyer checked out . . . right? Wrong. Although it's reported the Nevada state Legislature, in its semi-annual scramble […]

Hour 3

Hour 3 -- Vin Suprynowicz (Cont'd segment 1&2); Freedom's Phoenix Headline News

-30-

Hour 3

2016-01-20 Hour 3 Vin Suprynowicz from Ernest Hancock on Vimeo.

Vin Suprynowicz - Cont'd (Segment 1&2)

Ernest Hancock (Segment 3&4)

Freedom's Phoenix Headline News

=====================

News

News

SpaceX DID Land on Barge...

01-19-2016 • https://www.instagram.com/ElonMusk

...But then.....

Falcon lands on droneship, but the lockout collet doesn't latch on one the four legs, causing it to tip over post landing. Root cause may have been ice buildup due to condensation from heavy fog at liftoff.

view all 7,623 comments