IPFS News Link • Economy - International

Bond Yields Buoyed Around Globe as Fed Rate-Boost Odds Beat 50%

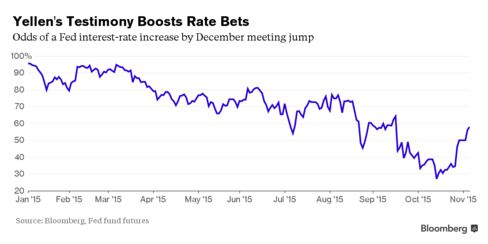

• http://www.bloomberg.comGlobal bond yields climbed to a seven-week high after Federal Reserve Chair Janet Yellen said a U.S. interest-rate increase remains a possibility for 2015.

Her comments Wednesday left the odds of the Fed tightening policy by its December meeting above 50 percent, while the yield on the Bloomberg Global Developed Sovereign Bond Index climbed to the highest since Sept. 16.

Benchmark 10-year Treasury yields also advanced to the highest since mid-September on Thursday. German bund yields reached a two-week high, even as investors awaited a potential boost to the European Central Bank's quantitative-easing program next month. And similar-maturity Australian yields jumped for a sixth day.

"The fact that Yellen repeated that the door was open for something in December is clearly bearish globally" so yields are "under upward pressure," said Patrick Jacq, a senior fixed-income strategist at BNP Paribas SA in Paris.

The increase in yields around the world underscores the Fed's influence on global debt markets. Treasuries are driving borrowing cost higher even as growth slows in China and central bankers in Europe and Japan signal they may increase their debt-purchase programs.

U.S. government securities have a correlation of 0.8 or more with markets including those in Australia, France, Germany and the U.K., data compiled by Bloomberg show. A figure of 1 would mean they moved in lockstep.

Yields Increase

U.S. 10-year note yields rose two basis points, or 0.02 percentage point, to 2.25 percent as of 8 a.m. in New York on Thursday, the highest since Sept. 17, according to Bloomberg Bond Trader data. The 2 percent security due August 2025 fell 5/32, or $1.56 per $1,000 face amount, to 97 27/32.