IPFS News Link • Housing

WSJ: "The U.S. Housing Boom Is Coming to an End"

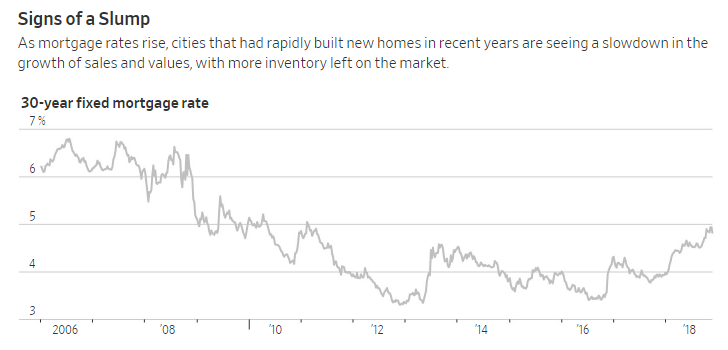

• https://goldsilver.com/blog/wsj-the-us-housing-booHigher mortgage rates following a multi-year period of almost impossibly low mortgage rates. Real estate investment buyers outbidding other speculators, driving up the prices of houses nationwide, as flipping came back into vogue.

When there's next-to-free money to be borrowed, you can bet it will be borrowed. By anyone who can get it, for any reason at all.

Lots of ZIRP-driven mortgage date was originated over the past decade. Now, with mortgage rates near 8-year highs, money isn't so free anymore.

And sellers now find a wildly frothed-out market desperately trying to maintain nosebleed pricing in the face of housing starts that are still ramping up despite falling sales.

And inventories are spiking dramatically in what were the hottest housing markets, yet sellers are still holding out for peak-bubble pricing.

1 Comments in Response to WSJ: "The U.S. Housing Boom Is Coming to an End"

Consider this one thing again. Regarding lending institution loans, does the promissory note you sign have any value without your signature? No! The lender won't give you any fiat if you don't sign. When you sign, then the note has value. How can you tell? The lender will give you some fiat in return for your note with your signature on it. The loan exists in the fact that you gave the lender your valuable note that has your signature on it. The lender almost immediately repays the loan you loaned him, with fiat or bank check. Search on "Tom Schauf."