IPFS News Link • Gold and Silver

Former Fed Chairman: Ron Paul was Right About Gold Standard, Central Banks

• http://www.trueactivist.com

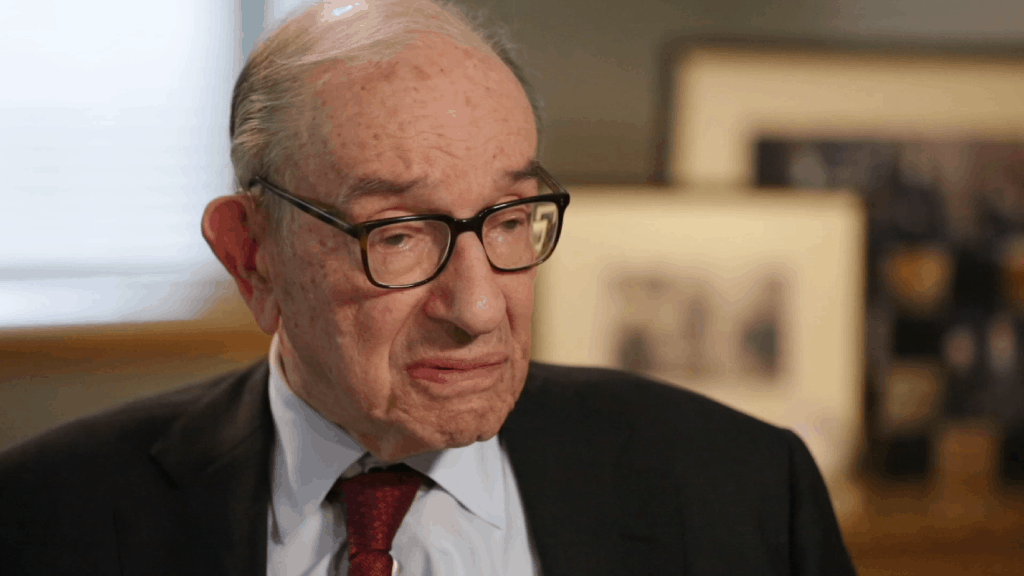

Credit – CNN

Former currency trader John Rubino recently remarked: "when history of these times is written, former Fed Chair Alan Greenspan will be one of the major villains, but also one of the greatest mysteries." Indeed, Greenspan – during his nearly 20 years as chairman of the Federal Reserve Bank – oversaw the inflation of several devastating economic bubbles as well as the economic crises that followed, including the 2008 sub-prime mortgage crisis. Yet, despite his decidedly "villainous" role in orchestrating irresponsible fiscal policy, Greenspan, both prior to and following his time as Fed chairman, has espoused decidedly libertarian views that stand in sharp contrast to the Fed's policies, making him somewhat of an enigma.

For example, in 1996, Greenspan wrote: "This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.." However, as Fed Chairman, Greenspan intervened at nearly every available opportunity, leading to a surge in the national debt over his tenure. While Chairman, he prevented the regulation of credit default swaps and other derivatives that exploded in 2008 while also cutting interest rates to practically zero after the 2001 "dot-com" bubble, which ultimately spurred the sub-prime mortgage crisis and housing bubble.

Upon his departure from the Federal Reserve in 2006, Greenspan began to – once again – embrace libertarian economic philosophy. Greenspan's latest interview with the World Gold Council, published in the February issues of Gold Investor, seems to suggest that he has full switched back to his views prior to his time presiding over the Federal Reserve. In the extensive interview, Greenspan makes some shocking claims, many of which stand in sharp contrast to his policies as Fed Chairman.

For instance, Greenspan said the following about the gold standard when asked what role gold should play in the new geopolitical environment:

"Today, going back on to the gold standard would be perceived as an act of desperation. But if the gold standard were in place today, we would not have reached the situation in which we now find ourselves. [T]here is a widespread view that the 19th Century gold standard didn't work. I think that's like wearing the wrong size shoes and saying the shoes are uncomfortable! It wasn't the gold standard that failed; it was politics. […] We would never have reached this position of extreme indebtedness were we on the gold standard, because the gold standard is a way of ensuring that fiscal policy never gets out of line."

The gold standard, of course, refers to a fixed monetary regime under which the monopoly government currency is fixed and may be freely converted into gold. The gold standard has become an important political issue in recent years, particularly during the 2012 Republican primary thanks to the candidacy of former Texas senator Ron Paul. Paul has argued for years that returning to the gold standard as well as auditing and limiting the power of the Federal Reserve are essential if the United States is to improve its economic situation. Perhaps the most shocking part of Greenspan's recent interview was his implicit admission that Paul has been right all along:

"When I was Chair of the Federal Reserve I used to testify before US Congressman Ron Paul, who was a very strong advocate of gold. We had some interesting discussions. I told him that US monetary policy tried to follow signals that a gold standard would have created. That is sound monetary policy even with a fiat currency. In that regard, I told him that even if we had gone back to the gold standard, policy would not have changed all that much."

While it is indeed surprising to hear these words from a former Federal Reserve chairman, Greenspan's recent statements are unlikely to influence current or future Federal Reserve policy. Current chairwoman Janet Yellen continues to follow the irresponsible policies of her predecessors – Greenspan included – as Fed policy since 2008 has arguably backed the US' central bank into a corner from which they are unlikely to escape without provoking a major economic crisis. Though a national return to the gold standard is unlikely, Greenspan's comments on gold are indeed salient, suggesting that purchasing gold or silver are indeed wise moves for any individual concerned about the ultimate and inevitable consequences of decades upon decades of irresponsible and downright dangerous central banking policy.