IPFS News Link • Economy - Recession-Depression

"The Market Is Broken" - Why Nobody Is Trading Any More

• Zero Hedge - Tyler Durden..."there is no liquidity", something we first highlighted at the start of the month when we pointed out "Two More Problems For The Bulls: Market Liquidity And Short Interest Are At All Time Lows."

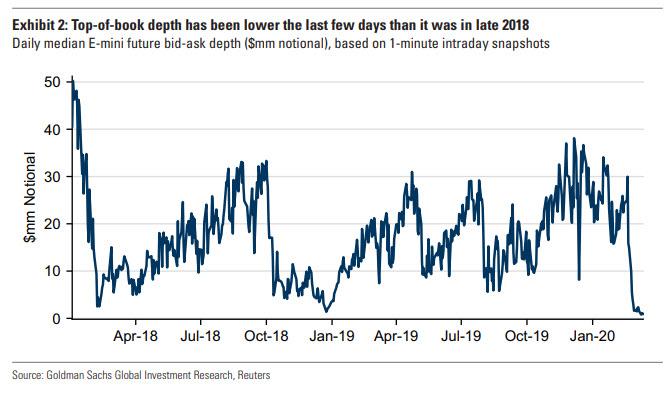

Why our constant focus on liquidity? Because as Goldman explained on Thursday, "liquidity and volatility are interconnected, creating a self-reinforcing loop, and as a result liquidity conditions have been an important contributor to the velocity of recent S&P 500 moves." Yet while liquidity had dipped in the past on numerous stressed occasions, what we saw in recent days has been borderline biblical as top-of-book depth for SPX E-mini futures, typically the conventional metric of liquidity representing the dollar-amount of SPX E-mini futures available to trade electronically on the typically 25-cent wide market, has - as Goldman put it - "started to lose meaning as fewer and fewer market participants are quoting one-tick-wide markets for the futures at all."

As Goldman further explained, as volatility spiked, electronic futures liquidity has fallen to the point where there has been a median of just 10 contracts, representing $1.5mm notional, on the bid and ask of E-mini futures screens over the past week (compared with a median of 120 contracts, representing $18mm notional, in 2019).