News Link • Economy - Economics USA

Race To The Financial Dung Heap

• https://www.zerohedge.com, by QTR's Fringe FinBut watching the headlines coming out of commercial real estate, private credit and subprime auto over the last week or two — and I'm not certain we don't have a new leader, or leaders, in the nationally televised Race To The Financial Dung Heap™.

Let's try to make this case as clear and as simple as possible, with examples and charts for people with very short attention spans, like myself.

First, commercial real estate. When the pandemic hit, it didn't just empty restaurants and stadiums—it hollowed out the very premise of office real estate.

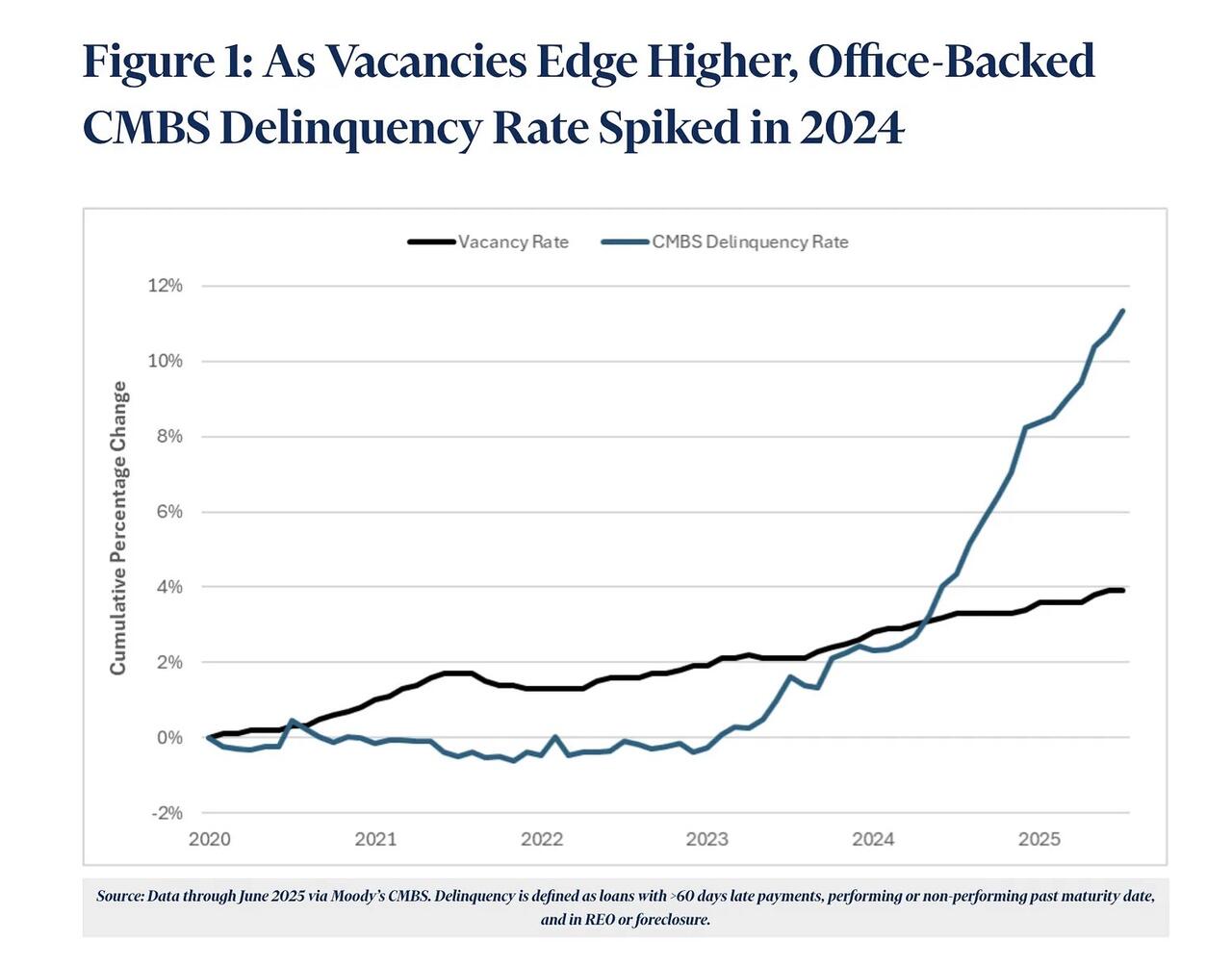

Remote work turned once-bulletproof towers into stranded assets almost overnight, leaving landlords with vacant floors, plunging rents, and billions in debt that no longer penciled out. We still haven't recovered.

By mid-2025, the U.S. office vacancy rate had climbed to a record 20.7%, according to Moody's Analytics.¹

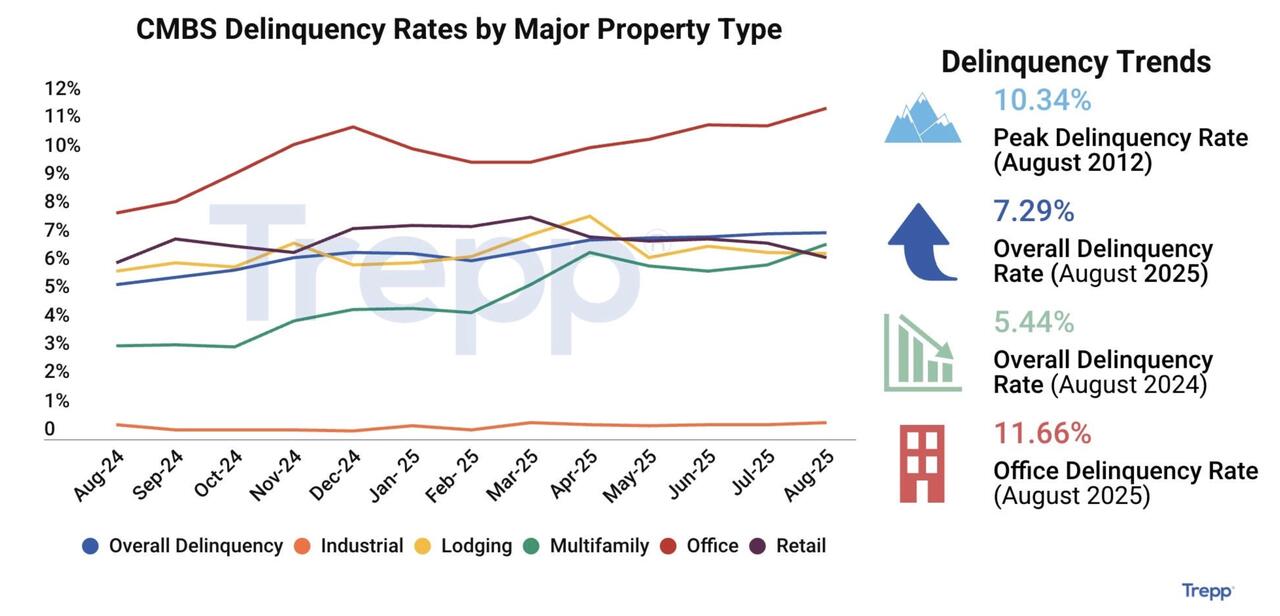

New York was in the middle of converting 4.1 million square feet of offices into housing, the most since 2008.? CMBS delinquency rates had risen for six straight months through August, hitting 7.29% overall and 11.66% for office loans, both records.² ³