IPFS News Link • Economy - Economics USA

What The Fed Reserve Is Going To Do & What Next Pres Should Do To Invigorate US Economy

• LewRockwell.Com - Bill SardiThere are sources that tell us precisely what is going to happen: The Congressional Budget Office and a few carefully selected other sources.

US lending institutions and the entire financial industry as well as U.S. companies are hooked on near-free money issued by the nation's central bank. This has created many zombie banks and companies as well as a stock market that is so propped one begins to wonder if any of these entities can survive an interest rate increase. [CBS Marketwatch July 31, 2015]

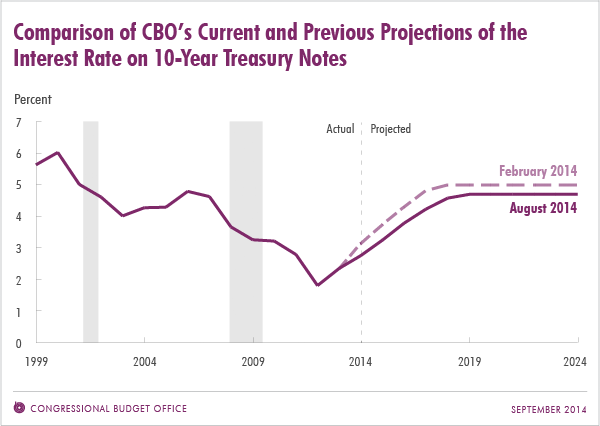

The Congressional Budget Office says…

Interest rates on money the Federal Reserve central bank issues to lender banks is going to gradually rise from 0.0-0.2% to ~3.5%. The Congressional Budget Office says this is going to happen in the second-half of 2015. That is the feared moment when the financial industry has to suddenly be weaned off of free money. [Congressional Budget Office]

This means that lenders will add two or three percentage points to that when they lend money to buy houses and automobiles, so consumers are likely to start paying 5.5-6.5% on a newly issued home mortgage instead of the prevailing 3.92%.

That will have serious repercussions in the housing market that will finally fall flat. The housing market has been falsely propped, first by no down-payment loans, then by low interest loans, then by those elite members of the financial classes who benefited from all this free money who bought $1+ million homes. Unless incomes begin to rise, the housing market is toast.