IPFS News Link • Currencies

Projecting The Price Of Bitcoin

• http://www.zerohedge.comThe wild card in cryptocurrencies is the role of Big Institutional Money.

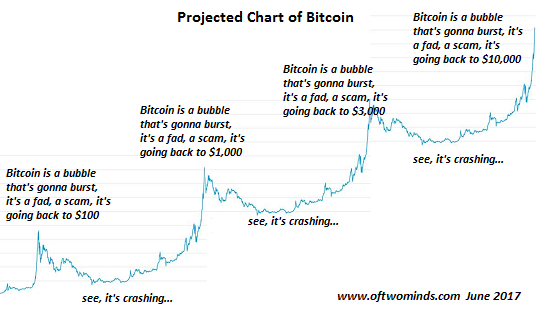

I've taken the liberty of preparing a projection of bitcoin's price action going forward:

You see the primary dynamic is continued skepticism from the mainstream, which owns essentially no cryptocurrency and conventionally views bitcoin and its peers as fads, scams and bubbles that will soon pop as price crashes back to near-zero.

Skepticism is always a wise default position to start one's inquiry, but if no knowledge is being acquired, skepticism quickly morphs into stubborn ignorance.

Bitcoin et al. are not the equivalent of Beanie Babies. Cryptocurrencies have utility value. They facilitate international payments for goods and services.

The primary cryptocurrencies are not a scam. Advertising a flawless Beanie Baby and shipping a defective Beanie Baby is a scam. Advertising a mortgage-backed security as low-risk and delivering a guaranteed-to-default stew of toxic mortgages is a scam.

The primary cryptocurrencies (bitcoin, Ethereum and Dash) have transparent rules for emitting currency. The core characteristic of a scam is the asymmetry between what the seller knows (the product is garbage) and what the buyer knows (garsh, this mortgage-backed security is low-risk--look at the rating).

Both buyers and sellers of primary cryptocurrencies are in a WYSIWYG market: what you see is what you get. While a Beanie Baby scam might use cryptocurrencies as a means of exchange, this doesn't make primary cryptocurrencies a scam, any more than using dollars to transact a scam makes the dollar itself a scam.

Bubbles occur when everyone and their sister is trading/buying into a "hot" market. Bubbles pop when the pool of greater fools willing and able to pay nose-bleed valuations runs dry. In other words, when everyone with the desire and means to buy in and has already bought in, there's nobody left to buy in at a higher price (except for central banks, of course).

At that point, normal selling quickly pushes prices off the cliff as there is no longer a bid from buyers, only frantic sellers trying to cash in their winnings at the gambling hall.

While a few of my global correspondents own/use the primary cryptocurrencies, and a few speculate in the pool of hundreds of lesser cryptocurrencies, I know of only one friend/ relative /colleague / neighbor who owns cryptocurrency.