IPFS News Link • Stock Market

Recession Countdown Begins: Treasury 2s10s Yield Curve Inverts For First Time In 12 Years;

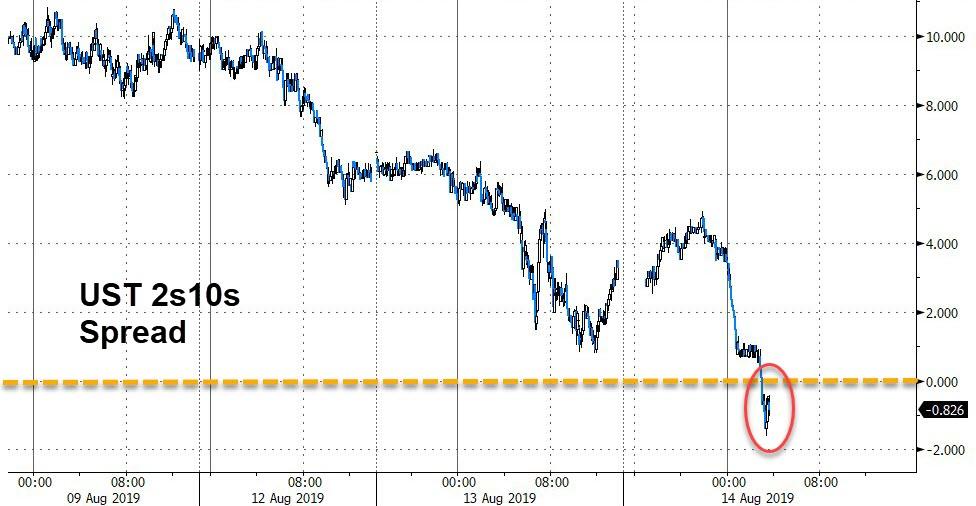

• Zero Hedge - Tyler DurdenWhile many have noted the inversion of the 3m-10Y segment of the US Treasury curve, mainstream investors appear more focused on the spread between 2Y and 10Y yields... and that has just inverted for the first time since May 2007.

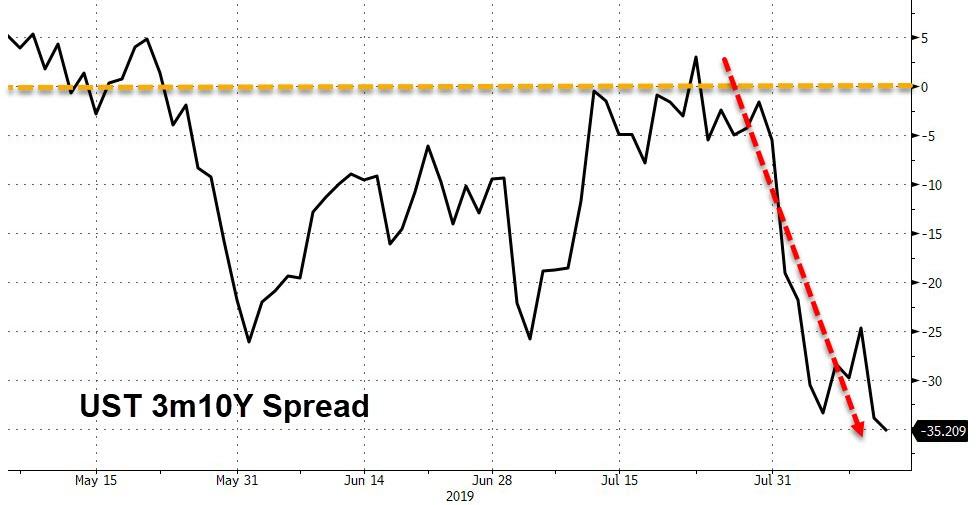

The spread between 3m and 10Y yields has been inverted since mid-May and reached its most inverted since April 2007 this morning...

Source: Bloomberg

But now, the 2Y-10Y spread ha collapsed into inversion...

source: Bloomberg

For the first time since May 2007...

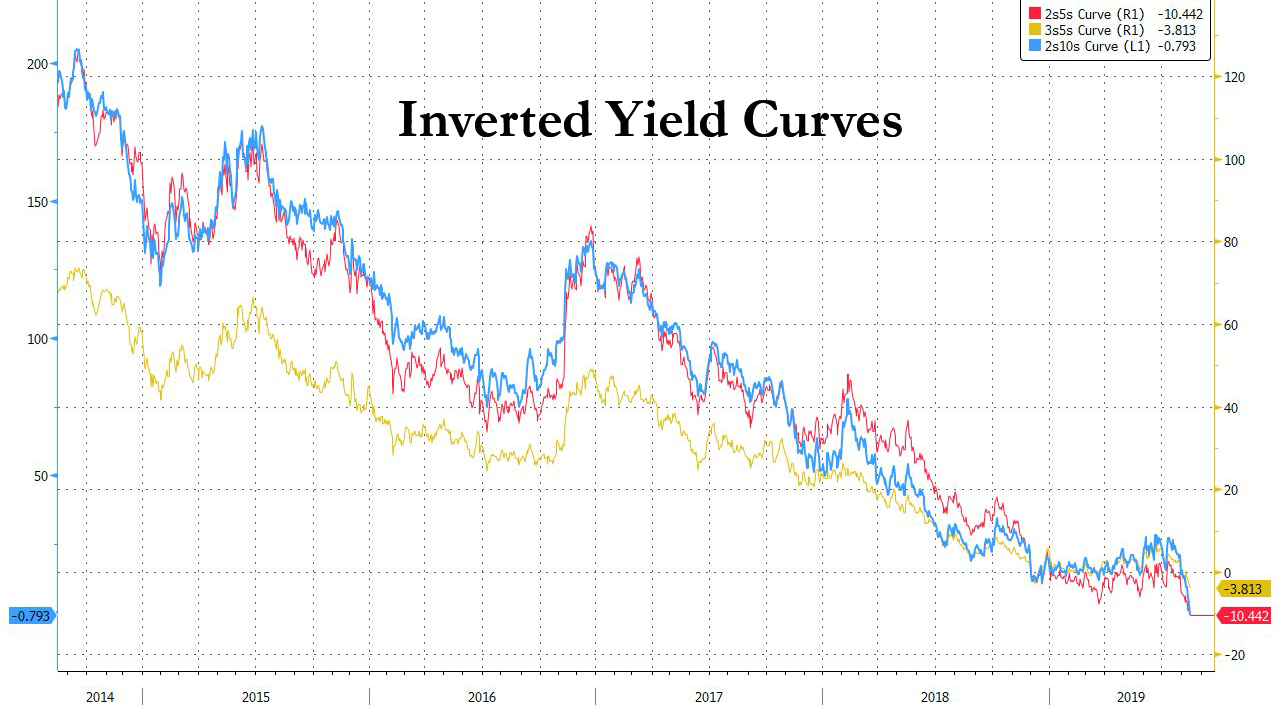

All major segments of the curve are now inverted

source: Bloomberg

...............................................................................................

"Actually we're reading the spread wrong," Larry Kudlow says of the flattening yield curve. "There's no recession in sight right now." #DeliveringAlpha https://t.co/gcJmBKvV1x pic.twitter.com/zj2SWqIXhd

— CNBC (@CNBC) July 19, 2018