News Link • Economy - Economics USA

Goldman Reveals Housing "Affordability Illusion" When Factoring Other Costs

• https://www.zerohedge.com, by Tyler DurdenAnd when voters talk about "affordability," they're most concerned about the basic cost of living. Beyond food and healthcare, nothing hits harder than housing costs.

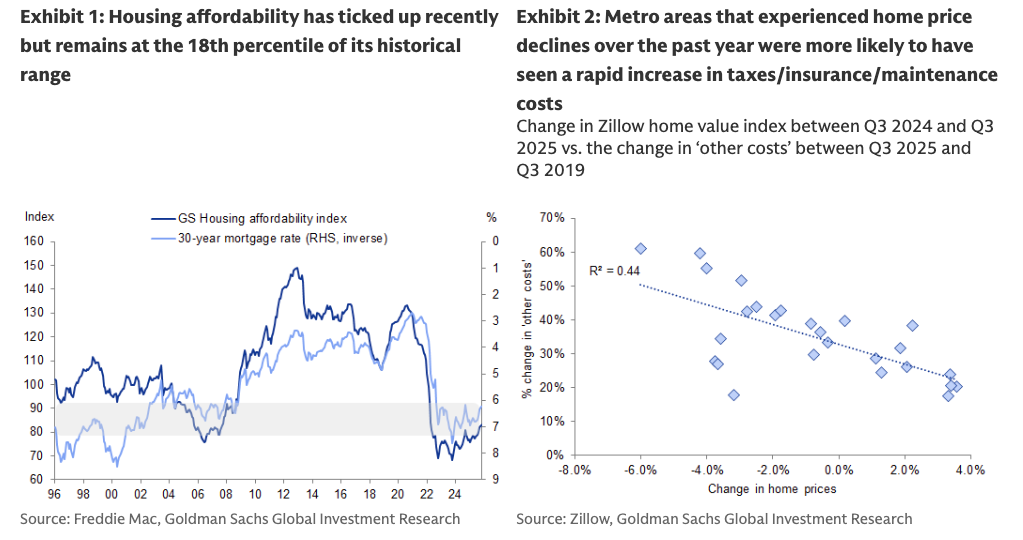

Goldman analysts led by Arun Manohar have some bad news on the housing affordability front: even with lower mortgage rates and slower home-price growth, it's largely an "illusion of affordability" once other ownership costs, such as taxes, insurance, and maintenance, are factored in.

Manohar explained more in a recent note to clients:

The most important topic of discussion in the housing market remains the challenging affordability situation. The recent decline in mortgage rates and the weak pace of HPA has resulted in housing affordability climbing to the highest level since 2022 (Exhibit 1). However, affordability remains low at the 18th percentile over the past 30 years. Although affordability has climbed, it is important to note that the standard affordability metrics do not capture all the costs of homeownership such as taxes, insurance and maintenance (collectively referred to as 'other costs'). To capture the effect of 'other costs,' we rely on estimates from Zillow for the monthly mortgage payment and total monthly payment on a new home purchased with the average interest rate of the month. The difference between the two series accounts for homeowner's insurance, property taxes, and maintenance costs. We find that metro areas that have experienced home price declines over the past year have generally witnessed greater increases in the 'other costs' over the past few years (Exhibit 2). Although falling home prices would typically make a home more affordable, prospective buyers may experience only partial relief since overall homeownership costs are not decreasing at the same rate as property values. With the median age of the US housing stock being over 40 years old, nationwide insurance premiums and maintenance expenses could increase further.

Mortgage rates are unlikely to decline enough to provide a significant boost to affordability in 2026.