IPFS News Link • Economy - Economics USA

Economy 2016: Here's What You Need to Know

• http://www.bloomberg.comSometime around April 2016, a third set of locks on the Panama Canal will begin handling ships as much as 2.6 times the size of the biggest ones now able to ply the waterway. U.S. ports from New York to Galveston, Texas, have been gearing up for the traffic. The Port of Houston Authority just finished installing four cranes that are 30 stories high. "More trade means more jobs," Port Chairwoman Janiece Longoria said earlier this year.

The opening of the Panama Canal locks is just one likely event in what promises to be an eventful year for the global economy. The Trans-Pacific Partnership trade agreement could win approval from 12 nations that together account for 40 percent of global output. There will be presidential elections in the U.S. and Taiwan, a Summer Olympics in Brazil, and a new five-year plan in China. The biggest event of all could be a referendum in the U.K.—possibly in October—on whether to remain part of the European Union.

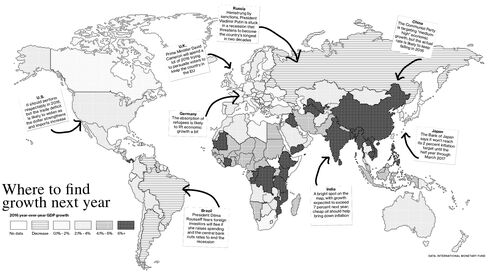

The world economy next year is shaping up to be stronger than in 2015 and roughly in line with long-term growth averages, according to the International Monetary Fund and economists surveyed by Bloomberg. But "a return to robust and synchronized global expansion remains elusive," the IMF said in its October outlook. The fund's economists project world growth of 3.6 percent, up from 3.1 percent this year and about the same as the 3.5 percent average from 1980 through 2014. Those numbers are based on the IMF's preferred method of measuring output, using the real purchasing power of national currencies. Measured the standard way—using market exchange rates—the IMF's projections and historical figures would be about 0.6 percentage point lower.

The coming year will be "OK-ish," says Adair Turner, former chairman of the U.K.'s Financial Services Authority and author of a new book, Between Debt and the Devil. More pessimistic than the consensus, he worries there will be undeclared currency wars as Europe and Japan try to cheapen their money to boost exports and employment at home—essentially stealing growth from their trading partners.

Here's the mainstream outlook in a nutshell: China will continue to decelerate. The U.S. will continue to outperform its rich-nation peers. With global demand soft, the price of money (interest rates) and the prices of oil and other commodities are likely to remain low. Central bankers Janet Yellen, Mario Draghi, and Haruhiko Kuroda will be in the spotlight as the Federal Reserve attempts to nudge rates higher and the European Central Bank and Bank of Japan look for ways to stimulate growth.