IPFS News Link • Stock Market

Morgan Stanley And Goldman Both Downgrade Tesla Citing China, Demand And Valuation

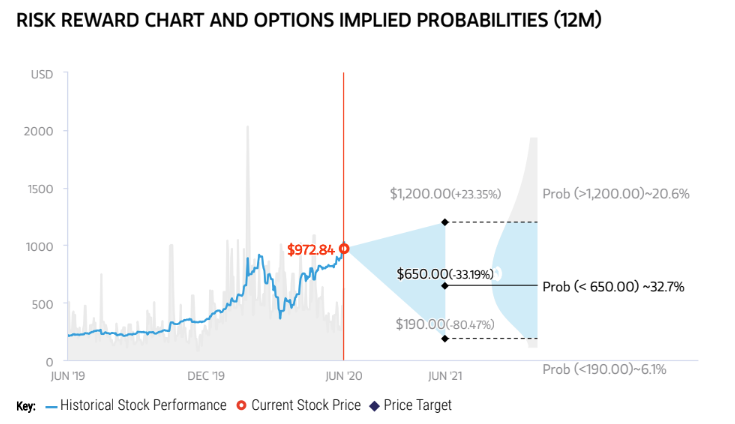

• Zero Hedge - Tyler DurdenPerpetual bull Adam Jonas at MS downgraded Tesla from Equalweight to Underweight with a price target of $650.00, down from $680.

Among his concerns, Jonas noted capital needs and near-term demand - issues we feel like we have been hearing about for years, all the while Tesla stock has squeezed higher and higher. "We're Underweight due to our concerns around China, competition, capital needs and near term demand. The RR skew for TSLA is consistent with an Underweight rating," the note reads.

In the short term, Jonas is worried about demand and pricing:

"Nearer term, we acknowledge that the company must continue to navigate challenges related to restarting its Fremont facility and confronting light vehicle markets that may not be as strong as pre-COVID levels. In recent weeks, Tesla has announced price cuts in China and the US across its model range that we had not previously incorporated into our forecasts, until now."

On a longer scale, he expressed concerns not only about China, but about inevitable competition from major companies like Amazon:

"We believe any potential deterioration of relations with China could disproportionately impact Tesla vs. other stocks within our coverage. Our relative caution on China drives our view that Tesla shipments in the PRC peak at just under 500k units by 2027 and decline from there."

"In a post-COVID world, we believe fewer and more powerful players will be in position to deploy capital and talent to solving autonomy with a 'play to win' mindset. We see Amazon (and other tech players) as clear competitors, not partners vs. the likes of Tesla and GM."