IPFS News Link • Federal Reserve

Nomura: "Fed Is Shorting S&P Calls"-Dynamic Remains Locked-And-Loaded

• https://www.zerohedge.com, by Tyler DurdenHowever, as Nomura's Charlie McElligott details below, there is a much stronger dynamic at play that is driving the daily roller-coaster in stocks - and may well continue through the FOMC next week (and the massive $3.3 trillion options expiration next Friday).

US Equities refuse to break-down and it need be noted, considering and thanks in large part to a lot of "contras":

1) the chronic underpositioning from both HFs and Systematics both being de facto "short" alongside historically high MF cash levels,

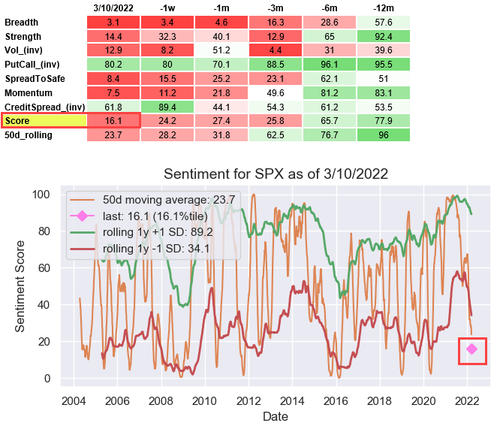

2) horrific Equities sentiment (our multi-asset SPX Sentiment Indicator at just 16.1%ile since 2004),

3) the absolute nothing-burger in the Ukraine "talks" yday,

4) the 40 year high US CPI print,

5) worsening Commod supply / demand realities extending the "inflation overshoot" risks and

6) Treasury Yields pushing back near local highs again on

7) re-escalation of "hawkish" CB expectations (pushing back up to 4.5 implied Fed hikes by July and 6.5 by Dec, with VERY real Delta of a 50bps in May)