IPFS News Link • Economy - Economics USA

Stocks Gain, All S&P Sectors Rise; Vix Slumps

• www.opednews.comThe economy is slipping back into recession, and was never really out of it, except in the Fed-primed FIRE sector. Inflation, driven by commodity speculation, will soon ebb as the money pump is turned off. And now that QE1 and QE2 have ended, we can see there was nothing in the real economy to keep the so-called recovery going.

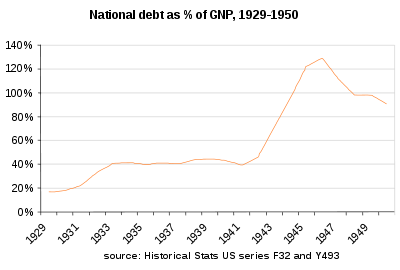

We are undergoing not a contraction, but a deleveraging. This could last 6 to 7 years , says The Economist magazine. That, to all but the elite, including those in Congress, who are on average, near millionaires, would constitute a depression, equal to the Great Depression. The current imbroglio over the unconstitutional, politically motivated debt-ceiling, is reminiscent of what happened in 1937, when FDR was convinced to pay down the debt, and turn back the New Deal programs. This resulted in slipping right back into a depression, which didn't end until the "stimulus" of WWII. It's worth noting that the debt, as a percentage of GDP, was considerably higher than it is now (<100%) during WWII, and FAR less in 1937 (40%):