IPFS News Link • Economy - Economics USA

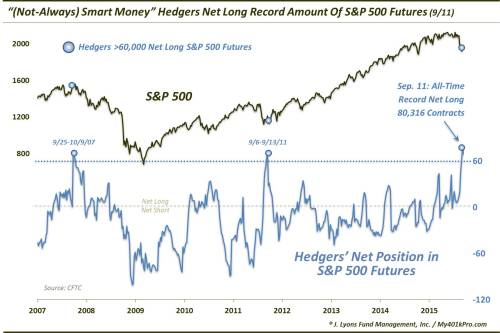

"(Not Always) Smart Money" Hedgers Are Record Long S&P 500 Futures

• Zero HedgeSome of these indicators have gotten a bit more complicated in recent years, however. One such example comes from the Commitment Of Traders report on S&P 500 futures out of the CFTC.

To refresh, the CFTC tracks the net positioning of various groups of traders in the futures market in the COT report. One such group is the Commercial Hedgers. As their name implies, their main function in the futures market is to hedge. By definition, therefore, they typically build up positions contrary to the prevailing trend. As a result, this group is typically correctly positioned (and extremely so) at major turning points in a market. It is for that reason that the group is usually referred to as the "smart money". However, that is not always the case. Consider the case of the Commercial Hedgers' position in the S&P 500 futures.

As of the September 11, 2015 COT report, Hedgers were holding an all-time record net long 80,316 S&P 500 futures contracts, as shown in our Chart Of The Day.