01-07-14 -- Patrick Byrne - (VIDEO & MP3 LOADED)

Hour 1 - 3

Patrick Byrne will be speaking at FreedomSummit2014

www.FreedomSummit.com

2014-01-07 Hour 1 Freedom's Phoenix Headline News from Ernest Hancock on Vimeo.

"Declare Your Independence with Ernest Hancock" - August 6th 2009

Ernest Hancock

Bud Burrell - Security Industries Veteran explains EXACTLY how America was Robbed! (Great Show... I highly Recommend you listen to this to understand what's happened and why)

Declare Your Independence with Ernest Hancock

"Declare Your Independence with Ernest Hancock" - August 19th 2009

Ernest Hancock

Bank of International Settlements - Depository Trust Company - Federal Reserve & the largest bank robbery in human history

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. Her training in finance and ec

(they are the “holders” of the actual stocks as far as I can tell). Now

we have "The BANK" (the Central Bankers we have been warned often about

by those tracking such things), The Bank of International Settlements has just announced their plan to “audit” the Federal Reserve (something that even the US Government can’t do).

(they are the “holders” of the actual stocks as far as I can tell). Now

we have "The BANK" (the Central Bankers we have been warned often about

by those tracking such things), The Bank of International Settlements has just announced their plan to “audit” the Federal Reserve (something that even the US Government can’t do).Entered on: 2008-07-24 09:29:49

I just wanted to post a link to deepcapture as it is directly related to counterfeiting securities. This site was founded by Patrick Byrne, CEO of Overstock.com, who has been fighting against counterfeiting and other abuses in our markets. This site contains much researched information you will not find anywhere else.

The Greatest Crime in History (Publisher: Audio - This you need to know)

06-13-2008 • Finacial Sense Newshour

(Audio) Mr. Bud Burrell of Scottsdale, Arizona, who has worked in high finance for over 35 years, lays bares the truth of how Americans have had their wealth stolen from them. Naked shorts, counterfeit stocks, and other means have cost Americans... Read Full Story

Phantom Shares - Emmy Award winning Bloomberg Movie

Ernest Hancock

DOWNLOAD Phantom Shares.asf (36.05 MB MOVIE)

Make a Comment • Send Letter to Editor

8,500 Banks may soon die

7-21-2008 • Daily Kos

Want to know what happens next? It’s ape ass ugly and it’s going to happen to you, so don’t say I didn’t warn you. Let’s tackle the topic at hand: The Ginormous Banking Enema of 2008

Make a Comment • Send Letter to Editor

Reported by Powell Gammill

DTCC, Markit Form OTC Derivatives Partnership

07-22-2008 • www.watersnews.com

The new company will provide a single gateway for confirming over-the-counter (OTC) derivative transactions globally. This will allow buy-side and sell-side OTC derivative market participants to confirm trades and to gain access to additional service

Make a Comment • Send Letter to Editor

Reported by Ernest Hancock

Eurex Will Offer Central Clearing Service for OTC Derivatives

07-22-2008 • www.securitiesindustry.com

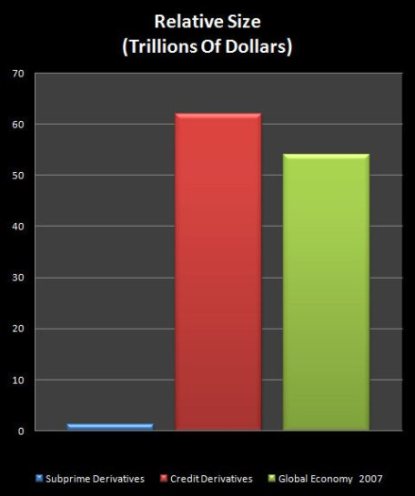

Designed to address industry concerns about systemic risk due to backlogs of transaction confirmations in the credit derivatives arena. (this means that the real value of $100's of Trillions in derivatives will be settled, stay tuned)

Make a Comment • Send Letter to Editor

Reported by Ernest Hancock

Markit and DTCC form derivatives trade processing JV

07-22-2008 • www.efinancialnews.com/

Single gateway for confirming OTC derivative transactions globally and the initiative will accelerate the adoption of electronic processing services across the rapidly growing $454 trillion OTC derivative market where around 50% of transactions are s

Make a Comment • Send Letter to Editor

Reported by Ernest Hancock

|

News Link • More about Federal Reserve The Federal Reserve is getting Audited by "Bank of International Settlements" 07-23-2008 • www.consciousmedianetwork.com George Green on the Economy (President Bush has agreed to the audit,... after he is out of office - Note: the Federal Reserve is immune from a US Gov't Audit) - The Bank of International Settlements is "THE BANK" that conspiracy advocat Read Full Story Make a Comment • Email this News Link • Send Letter to Editor |

|

Reported by: Ernest Hancock |

Members of the depository deliver securities between each other via computerized bookkeeping entries.

This reduces the physical movement of all the stock Certificates.”

Subject: New Automated Interface between the Federal Reserve

News Link •

News Link • Economy - Economics USA

Could the Banksters Grab Your Bank Deposits?

01-07-2014 • www.infowars.com

The above article explains that most of us do not realize that when you deposit money in a bank, that it becomes the property of the bank and we become unsecured creditors of the bank!

The above article explains that most of us do not realize that when you deposit money in a bank, that it becomes the property of the bank and we become unsecured creditors of the bank! “Although few depositors realize it, legally the bank owns the depositor’s funds as soon as they are put in the bank. Our money becomes the bank’s, and we become unsecured creditors holding IOUs or promises to pay. (See here and here.) But until now the bank has been obligated to pay the money back on demand in the form of cash. Under the FDIC-BOE plan, our IOUs will be converted into “bank equity.” The bank will get the money and we will get stock in the bank. With any luck we may be able to sell the stock to someone else, but when and at what price?” NationofChange

Hour 2

2014-01-07 Hour 2 Freedom's Phoenix Headline News from Ernest Hancock on Vimeo.

Uploaded on Jun 5, 2011

COLLIER COUNTY, Fla. - A bank foreclosure story you've got to see to believe. A Collier County couple turns the tables on Bank of America, the bank that tried to foreclose on their home. Now, the family is foreclosing on the bank! Even bringing trucks and deputies ready to seize property.The foreclosure nightmare started when Warren and Maureen Nyerges paid cash for a home owned by Bank of American in the Golden Gate Estates. They never had a mortgage whatsoever. But, the bank fouled it up and wound up issuing a foreclosure through their attorney.

The couple took their case to court and after a year and a half nightmare the foreclosure was dropped. A Collier County judge said Bank of America has to pay the couple's $2,534 legal fees for the error. After more than five months the bank still hadn't paid up. So, the homeowners' attorney did just what the bank would do to get their money, legally seize their assets.

"I instructed the deputy to go in and take desks, computers, copiers, filing cabinets, including cash in the drawers," Attorney Todd Allen told WINK News.

Outside the Bank of America on Davis Boulevard, several deputies stood by with movers ready to start hauling out the bank's office supplies and furniture.

Inside, the homeowners' attorney was locked out of the bank manager's office by deputies while the bank manger tried to figure out what to do.

Allen says the manager was visibly shaken, "Having two Sheriff's deputies sitting across your desk, and a lawyer standing behind them, demanding whatever assets are in the bank can be intimidating. But, so is having your home foreclosed on when it wasn't right."

After about an hour the bank finally cut a check to satisfy the debt, and no furniture was taken. A representative for Bank of America issued a statement saying they are sorry for the delay in issuing funds. They claim the original request went to an outside attorney who is no longer in business.

As for Allen, he calls this a symptom of a larger problem he sees often in the courts, where banks don't perform their due diligence on foreclosure cases. "As a foreclosure defense attorney this is sweet justice."

Read more: http://www.winknews.com/Local-Florida...

_________________________________________________

Feature Article • Ernie's Favorites Edition Feature Article • Ernie's Favorites EditionEconomy - International Understanding How Screwed We All Are - "The Greatest Depression" – by Ernest Hancock Ernest Hancock (August 1st 2009 - Originally posted July of 2008 - Some of these things have yet to pass - Listen to the first link to a very informative interview and be afraid... this whole thing has just started) I'm starting to see the pattern in the tapestry. |

Hour 3

2014-01-07 Hour 3 Patrick Byrne from Ernest Hancock on Vimeo.

Patrick M. Byrne (born 1962, Fort Wayne, Indiana, United States) is an American entrepreneur, e-commerce pioneer, CEO and Chairman of Overstock.com, In 1999, Byrne took control of the company, then called D2: Discounts Direct, and changed its name to Overstock. He had previously served shorter terms leading two smaller companies, including one owned by Warren Buffett's Berkshire Hathaway.

In 2002, Byrne took Overstock.com public. Since the initial public offering, the company has since increased its revenue to over $1 billion a year, and achieved full profitability in 2009.

Beginning in 2005, Byrne become known for his campaign against the practice of naked short selling. Byrne says it has been used in violation of securities law to hurt the price of his and other companies' stock. Under his direction, Overstock.com has filed two lawsuits alleging improper acts by Wall Street firms, a hedge fund, and an independent research firm.

Patrick Byrne is the son of John J. Byrne, former chairman of Berkshire Hathaway's GEICO insurance subsidiary and White Mountains Insurance Group. He holds a certificate from Beijing Normal University, has a Bachelor of Arts degree in Chinese studies from Dartmouth College, a Master's degree from Cambridge University as a Marshall Scholar, and a Ph.D. in philosophy from Stanford University.

Byrne was a teaching fellow at Stanford University from 1989 to 1991 and was manager of Blackhawk Investment Co. and Elissar, Inc. He served as Chairman, President and CEO of Centricut, LLC, a manufacturer of industrial torches, then held the same three positions at Fechheimer Brothers, Inc., a Berkshire Hathaway company manufacturing police, firefighter, and military uniforms.

In 1999, Byrne was approached by the founder of D2-Discounts Direct, asking for capital. The company had generated slightly more than $500,000 in revenue the previous year by liquidating excess inventory online. Byrne found the idea of online closeouts intriguing, and invested $7 million for a 60 percent equity stake in the company in the spring of 1999. In September the same year he took over as CEO, and the following month the company was renamed Overstock.com.

During a vacation in Southeast Asia Byrne found that many village artisans were held back by the lack of retail channels, as their production was fragmented and the quantities produced were small. He decided that the Overstock model was perfectly suited for their needs. In 2001 he therefore set up the Worldstock division of Overstock. Worldstock searches through villages all over the world for people capable of producing quality products, by 2006 there were approximately 6,000 producers contributing. On average, about 70 percent of the retail price on all Worldstock items sold goes directly to the artist.

Byrne initiated a Dutch auction IPO of Overstock.com in 2002. The company was one of the first to go public under a system advanced by WR Hambrecht + Co to retain a greater share of capital within the company rather than going to the investment bank underwriters used in conventional public offerings. Byrne has said that competing banks reacted against this, attempting to obstruct the success of the offering through negative reports and by shorting the company's stock. When Google later in 2004 went public via a Dutch auction IPO, Byrne commented that Wall Street firms similarly pushed negative stories, but did not keep it from going forward successfully. Four years after the OpenIPO, one official of Hambrecht, its now former co-CEO Clay Corbus was added to Overstock's board of directors.

Overstock.com CEO Patrick Byrne is often in the news regarding his efforts to curtail injustice. These include his efforts to combat global poverty (through our Worldstock department and products), improve educational outcomes for the less fortunate (through his work with the late Milton Friedman and his support of Milton and Rose Friedman Foundation's school voucher initiative), battle the pernicious effect on America of Wall Street corruption in the form of naked short selling and collusion among hedge funds, prime brokers, and a few research analysts (as are detailed in lawsuits Overstock has filed against Gradient Analytics, Rocker Partners

& Wall Street's major prime brokers), and expose corruption in business journalism via a handful of shill journalists who seek to hijack social media's discourse regarding this scandal so that understanding does not form within the Blogosphere.

In a conference call with analysts in August 2005, Byrne said that "there's been a plan since we were in our teens to destroy our stock, drive it down to $6--$10 ... and even a plan for how the company would then get whacked up." He said that the conspirators were part of a "Miscreants Ball," headed by a "Sith Lord," who he refused to identify but said "he's one of the master criminals from the 1980s." Byrne said the conspiracy included hedge funds, journalists, investigators, trial lawyers, the SEC, and Eliot Spitzer. Fortune writer Bethany McLean said that Byrne had become a "hero to those who believe that short-sellers are the operators of Wall Street's ultimate black box, predators who destroy companies through innuendo, bullying, political connections--and sometimes through an illegal practice known as 'naked shorting.'" Byrne financed and largely wrote a full-page advertisement in the Washington Post which said "Naked short-selling ... is literally stealing money from the widows, retirees, and other small investors." In a letter to the Wall Street Journal in April 2006, Byrne contended that "blackguards have practiced 'failure to deliver'" of securities, were "destroying businesses and (probably) destabilizing our capital markets." Since 2005, Overstock has filed two lawsuits relating to the matters under Byrne's direction.

In the first lawsuit, filed 2005, Overstock.com filed suit against hedge fund Rocker Partners and the equities research firm, Gradient Analytics (formerly Camelback Research Alliance), saying they illegally colluded in short-selling the company while paying for negative reports to drive down share prices. The defendant (i.e. Gradient Analytics et al.) moved to have the case dismissed, however the California court ruled in August 2006 that the suit should be allowed to proceed. Gradient filed a counter-complaint against Byrne for libel. A portion of this suit was settled out of court on October 13, 2008, when Overstock.com and Gradient dropped the claims against each other after Gradient retracted allegations that Overstock's reporting methods did not comply with rules established by the FASB, stated they believed Overstock.com complied with GAAP standards, and that three directors were independent, and apologized. In December 2009, the suit against Rocker, whose name had since been changed to Copper River Partners, was settled by Copper River paying $5 million, payment of which Byrne stated he received on December 9, 2009.

Overstock.com filed a second lawsuit in 2007 against a number of large investment banks relating directly to alleged illegal naked short selling. Both cases remain in litigation.

Byrne's campaign against naked short selling and others who he feels have targeted him and his company has attracted controversy. In her article on Byrne's 2005 conference call, Bethany McLean said "From a distance he seems like a bully, accusing people who depend on their reputations of corruption. The time is rapidly approaching when he will have to deliver--both the numbers to prove that the business can make money and the facts to prove that the Sith Lord exists." In a column in the New York Times in February 2006, journalist Joseph Nocera described Byrne's actions as a "campaign of menace" and as an attempt to silence Overstock.com's critics. MarketWatch's Herb Greenberg has called Byrne the runner-up for Worst CEO of the Year two years running. One of Byrne's claims, that naked shorting can cause heavy dilution of a company's stock by creating sales untied to any specific shares, has been criticized by Wall Street Journal columnist Holman W. Jenkins. Byrne has cited Overstock.com as an example of a company whose shares have been more than 100% sold short in one quarter, but Jenkins suggests that this merely reflects Overstock.com's heavy trading volume and relatively small public float. Jenkins further argues that brokers are inherently cautious in using the practice, due to the high risk of trading shares that are not guaranteed to be available. Byrne has denied that his campaign is primarily about Overstock.com. However, Byrne has also received favorable coverage, and was featured in a Bloomberg Television show on Naked Short Selling, "Phantom Shares", in March 2007.

In March 2006, John (Jack) Byrne, chairman of Overstock.com and father of Patrick Byrne, said that he was thinking of stepping down in disagreement over the campaign against naked shorting. In April 2006, John Byrne stepped down to become vice-chairman, and in July of that year he resigned from Overstock's board of directors. In August 2008, Jack Byrne said that after "much initial skepticism" he believed his son was "right all along" about the battle and lawsuits with short-sellers and analysts.

Byrne was instrumental in Utah's passage of a law aimed at curbing naked short selling. The legislation was repealed in February 2007, after state representatives were advised that it probably would not withstand judicial scrutiny due to federal preemption. Byrne criticized the repeal, but Senate Majority Leader Curtis Bramble said that legal advisers believed that the state would lose any litigation over the law.

A Securities and Exchange Commission investigation of Gradient was initiated but then dropped in February 2007. In July 2007, two American Stock Exchange options market makers were fined and suspended for using Regulation SHO exemptions to "impermissibly engage in naked short selling" in trades involving options and stocks for their own account. Overstock shares were believed to be among the stocks traded. The market makers settled without admitting or denying the allegations. None of the defendants sued by Overstock were named in the decision, but the Dow Jones News Service said that the decision was likely to be used by Byrne in pursuing his case.

After the crisis in the North American markets in 2008, Byrne received positive press. A Salt Lake Tribune article reported that "These days, when people talk of Byrne, the word 'vindication' comes up a lot."

Bitcoin

Overstock CEO: Why we're accepting bitcoins

01-07-2014 • CNBC.Com

Overstock.com has become the first major online shopping retailer to accept the digital currency bitcoin as payment in exchange for any of our million products. We are doing this for both business and philosophical reasons.

This version of the video includes Dr. Byrne's PowerPoint presentation.

1 Comments in Response to 01-07-14 -- Patrick Byrne - (VIDEO & MP3 LOADED)

In the last minute or two of his visit at DYI this morning, Patrick mentioned something about a loyalty oath to Obama by some group.

I find this interesting.

In 1688, the English Bill of Rights was penned. Subjects vowed their loyalty to the person of the King and/or Queen.

About 100 years later, the Constitution for the USoA was penned. Its oaths are to the document itself (and any embodied principles), NOT to a person. All the complaints in the Declaration of Independence are about actions of a King - a person. Framers apparently saw no need to place hope/loyalty in a person.

Whatever effect an oath may actually have, to whatever allegiance is sworn, I think Byrne must have at least picked up on the fact that an oath to a person sounded odd. To American ears it should.

DC Treybil